Tracking tariffs & expenses on orders in inFlow

We understand that navigating international shipping can often lead to unexpected costs, like tariffs, which can be frustrating.

To help you manage these additional expenses, you can easily enter unexpected fees in the Non-vendor, and Non-customer costs field on your purchase and sales orders in inFlow. We’re here to support you through the process!

Web

Are Non-vendor costs paid to the vendor?

Non-vendor costs won’t be included in the total of your purchase order, so they won’t be paid to your vendor. They’ll still be considered in the overall cost of your product. You can learn more about how inFlow calculates product costs from this guide.

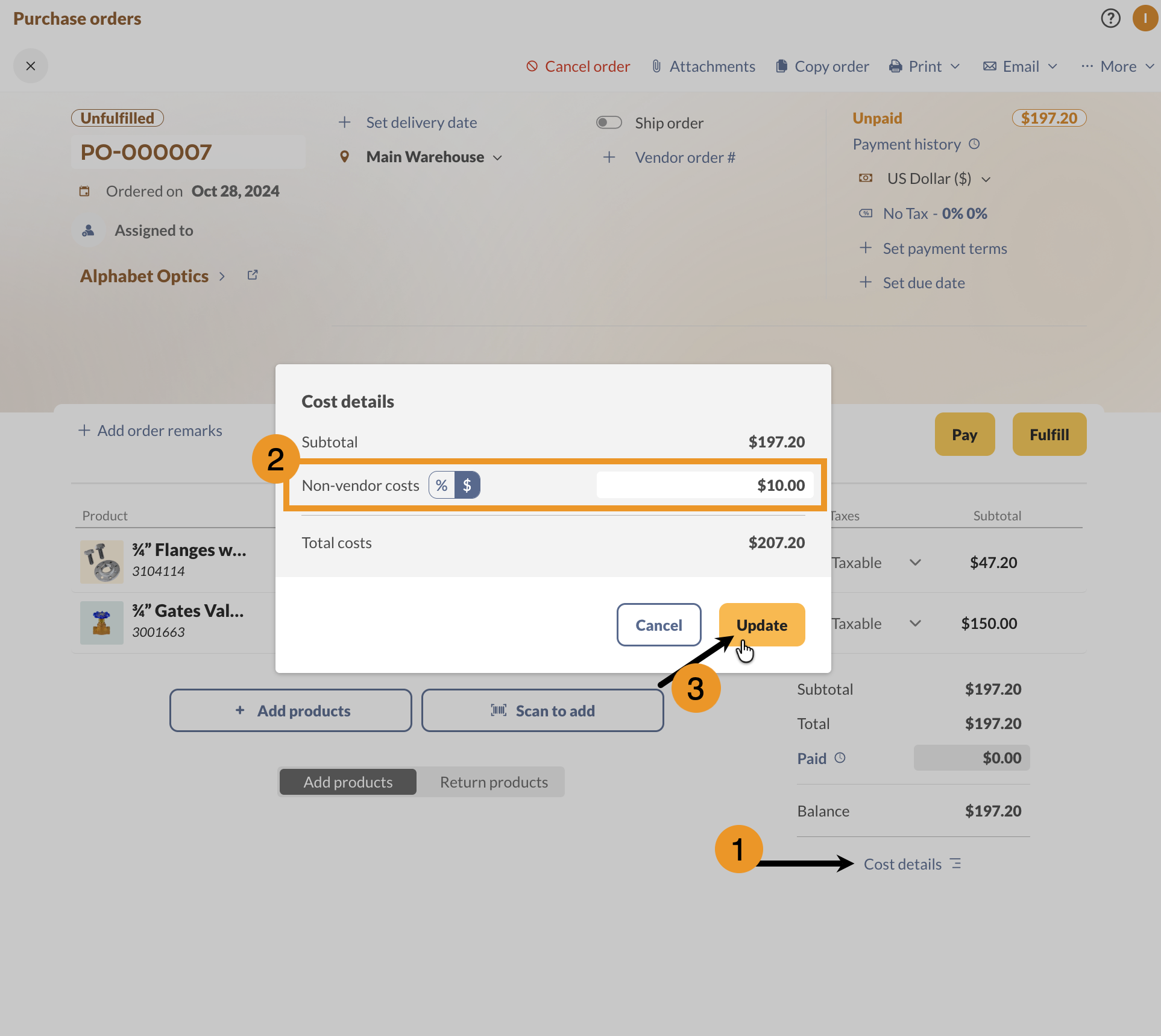

Tracking purchase order expenses, fees, etc (Non-vendor costs)

- On a purchase order, click on Cost details

- Select the “%” or “$”, then enter the amount in the non-vendor costs field.

- Click Update.

- Save the purchase order when done.

Are Non-customer costs paid by the customer?

Non-customer costs will not be included in the total for your sales order, so your customer will not be charged for them. Any amounts entered in this field will be deducted from the product profits in the sales order. For a detailed breakdown of your product profits, take a look at the Sales Profit Report.

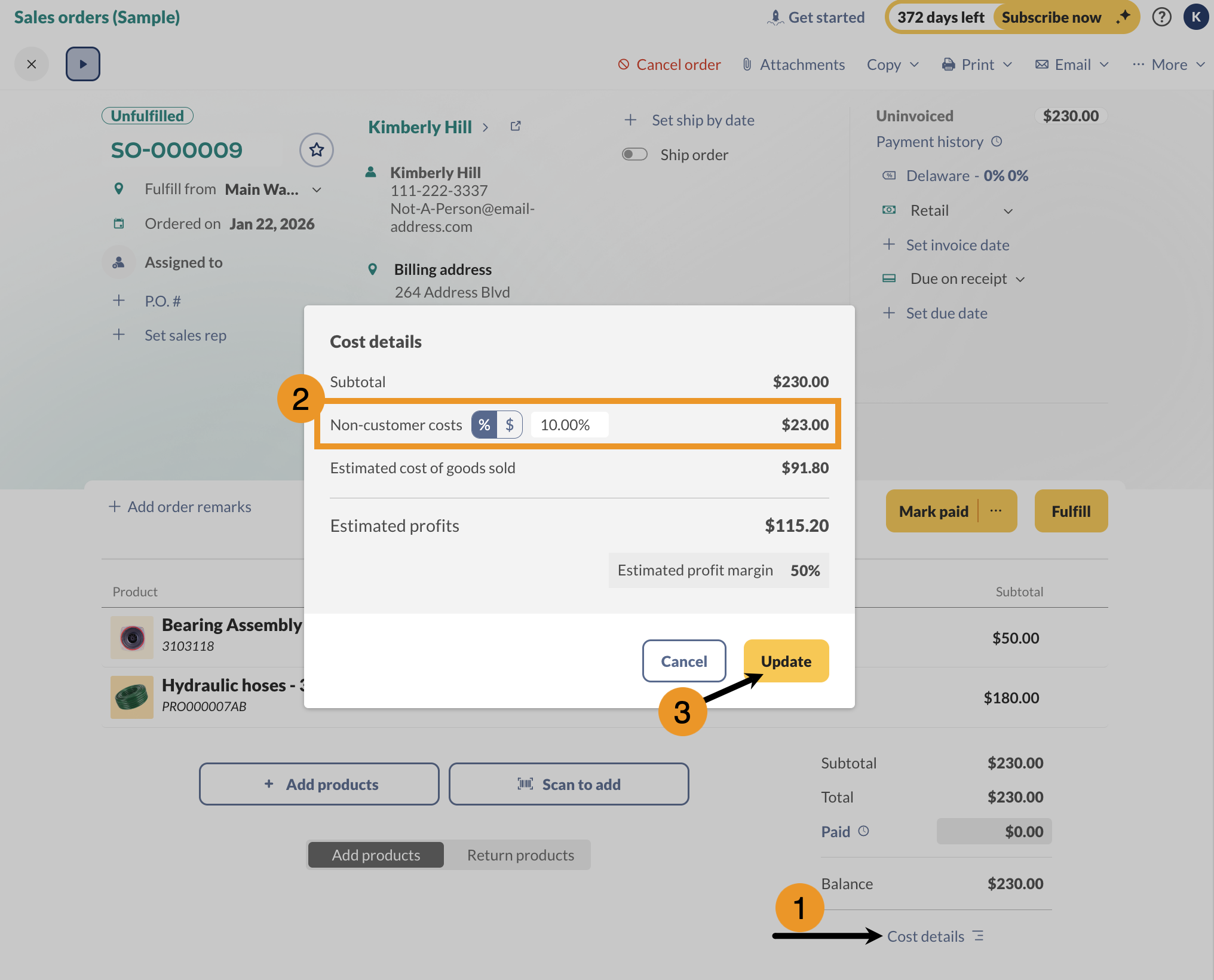

Tracking sales order expenses, fees, etc (Non-customer costs)

If you need to track expenses that aren’t charged to your customer, you can use the Non-customer costs field.

- Open a sales order, then click Cost details.

- Select the “%” or “$”, then enter the amount in the Non-customer costs field.

- Click Update.

- Save the sales order when done.

Windows

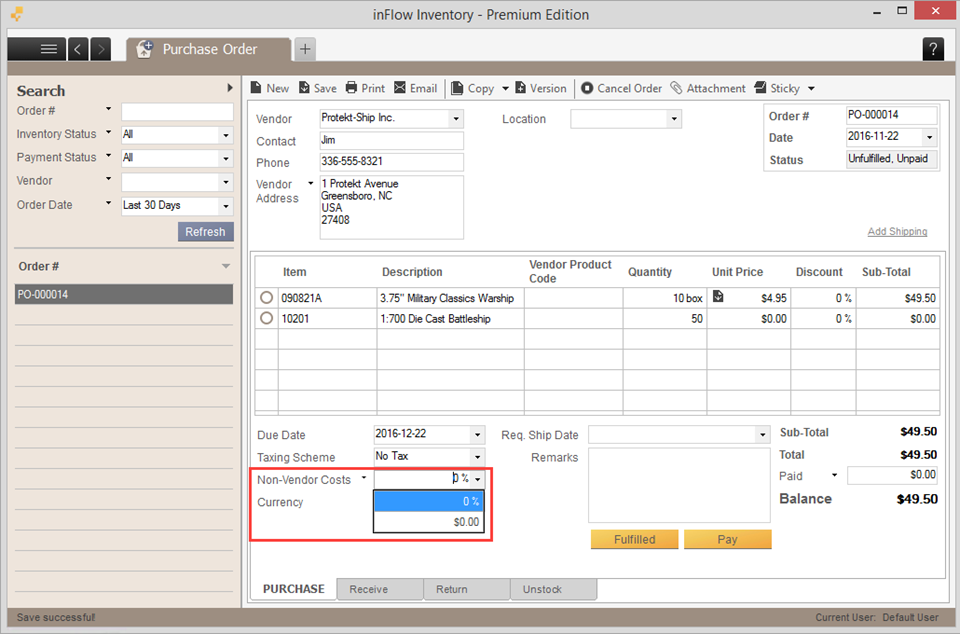

Non-vendor costs

This charge will not add to the total of the purchase order itself, but will include that amount in the total cost of your item (placing it in the product record for profit calculations later)

The non-vendor costs field is located in the bottom-left corner of your purchase order screen.

You can also find the sales equivalent for this at the bottom left of the Sales Order, under Non-Customer Costs.

How is the non vendor invoices or bills linked to the shipments and POs?