How to set up your taxes in inFlow

Taxing schemes calculate your taxes when completing sales and purchase orders. See below for steps on how to add taxes to inFlow.

Web

You can find tax setup steps in the video above at the 1:19 mark.

How to add taxes to inFlow

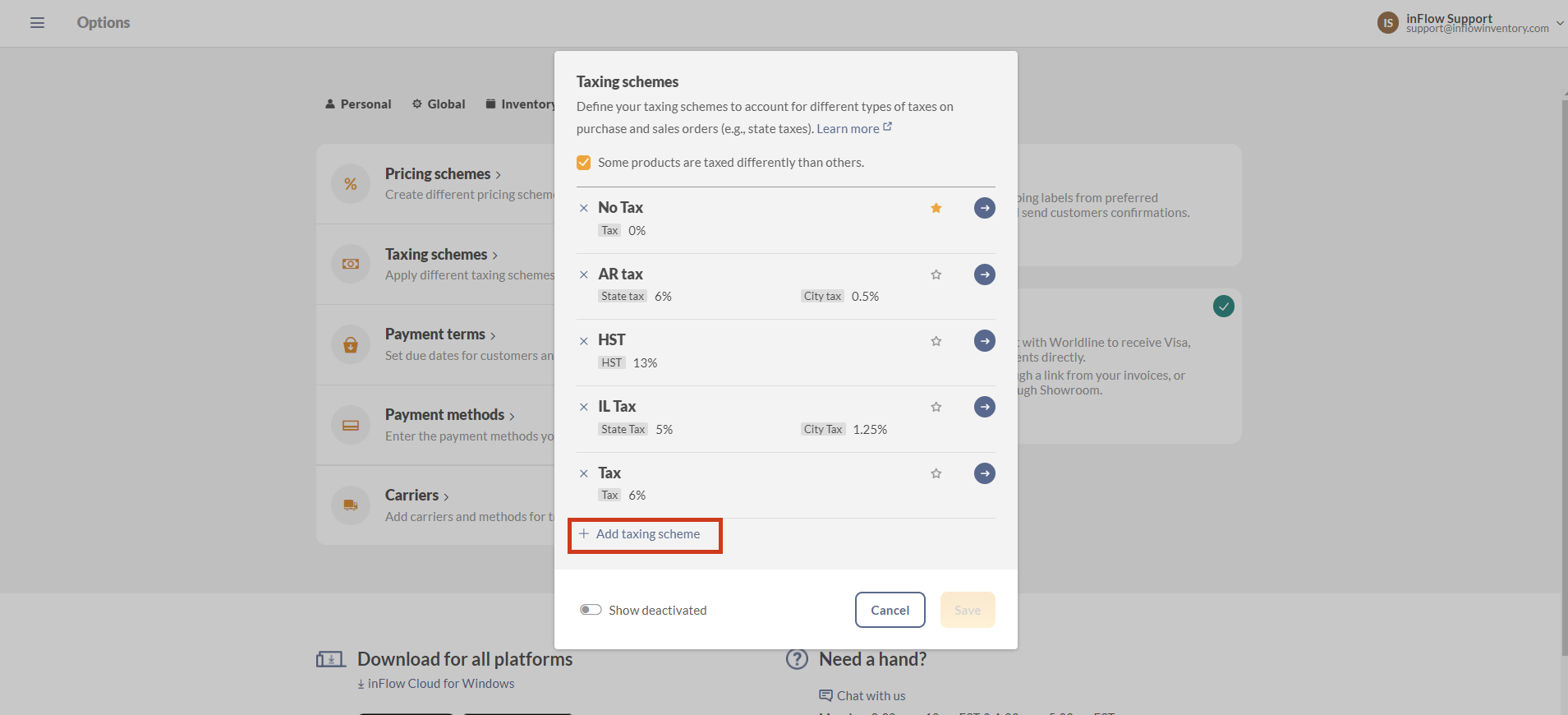

- Go to inFlow’s Order settings (Main Menu > Settings> Orders).

- Click on Taxing schemes.

- From here, click on +Add taxing scheme.

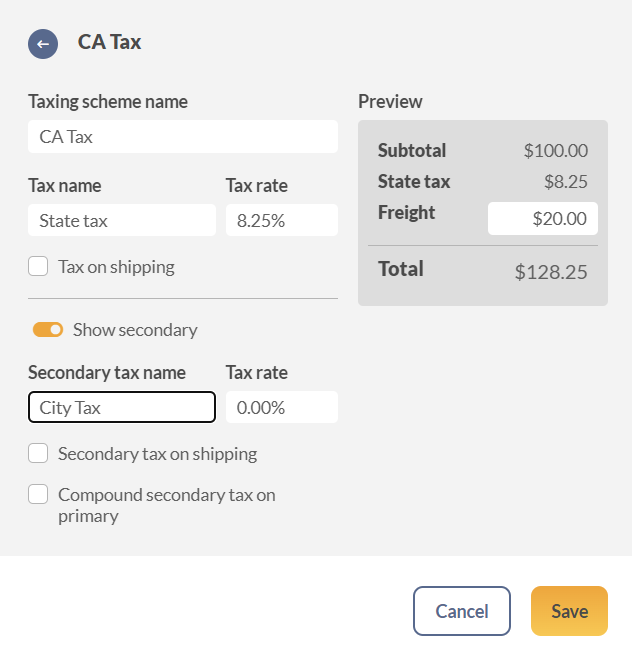

- Enter the tax name and rate. If you need to break down your tax further, toggle on Show secondary

- Click Save when done.

Once the taxing scheme has been added to inFlow, you can choose that tax directly on sales or purchase orders.

Secondary tax options

Secondary tax on shipping

Turning on this setting will add the secondary tax to the shipping fee.

What is “compound secondary tax on primary”?

A compound tax is a tax that is calculated on the original price of a product or service, as well as on any taxes that have already been added.

This means the tax applies not only to the price of the product itself but also to the taxes included in that price.

Looking for more info on taxes?

Here are some other things you can do with taxes in inFlow:

Windows

How to add taxes to inFlow

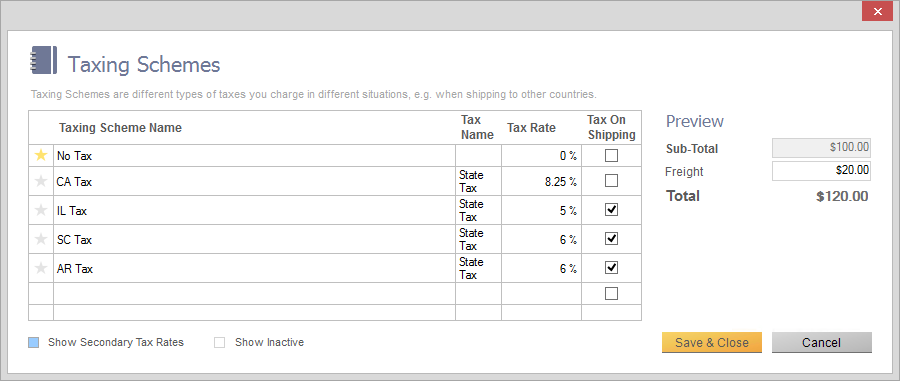

- Click the Main Menu > Options > Settings.

- Scroll down to the Taxes section and click the Manage Taxing Schemes button.

- Give your taxing scheme a name. Provide your tax name(s) and percentage(s).

- Click Save & Close.

You may want to select your tax as the default scheme. This tells the program to charge that tax on all new orders going forward (unless the vendor or customer has their own default scheme).

To do so, click the star next to the taxing scheme you want to set as the default.

Looking for more info?

Here are some other things you can do with taxes in inFlow:

0 Comments