Feeling a little nervous about your business’s future? You’re not alone. Data suggests that overall confidence amongst small business owners is at its lowest since at least 2017, when the survey began. But it’s not all bad news. Even with talks of a looming recession, there are steps businesses can take to not only weather the storm but prosper.

Today, we’re taking a look at how businesses might be affected, including what they’re doing now and how to make money during a recession with proper inventory control.

How often does a recession happen?

We hear the terms recession, downturn, and shrinkage a lot, but there is an important difference between the three. So, when does a recession happen? As Santander Bank explains:

“The economy goes through cycles of highs and lows, much like a wave in the ocean…. When it goes down, it’s called “economic contraction” (or “downturn”) …. If the economy shrinks for two consecutive quarters, it is said to have gone into recession.”

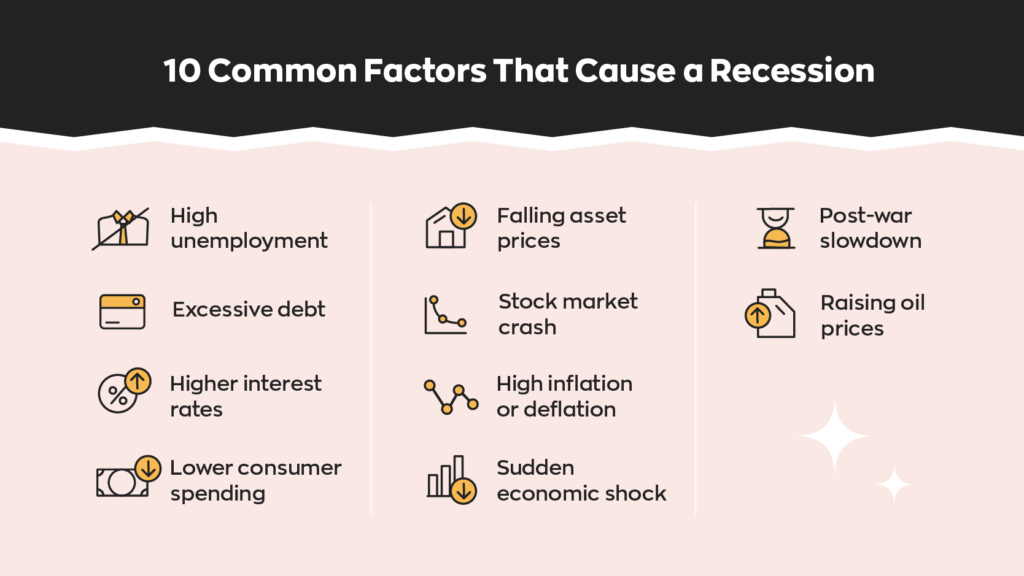

However, it’s not always that simple. The US National Bureau of Economic Research explains that there are a range of factors they consider when deciding if the country is in a recession. These include employment as measured by the household survey, real personal income minus government transfers, and wholesale-retail sales adjusted for price changes, amongst others.

What’s more, economists usually determine that a recession has started once they have all the necessary available data for a period. So, we find out we’re in a recession once it has already begun.

High inflation is sometimes a predictor of recession. The World Economic Forum explains that “since the 1950s, every time inflation has exceeded 4% and unemployment has been below 5%, the U.S. economy has gone into a recession within two years”. Today, those figures are 8.5% and 3.6% respectively.

How does inflation impact inventory?

As of August 2022, 43% of small business owners say that inflation is the biggest risk to their business. That’s up from 38% the previous quarter. What does this mean for businesses?

Inflation can change profit margins and cause issues with product and parts availability. Only 2% of companies have visibility into their supply base beyond the second tier, which could make anticipating problems difficult.

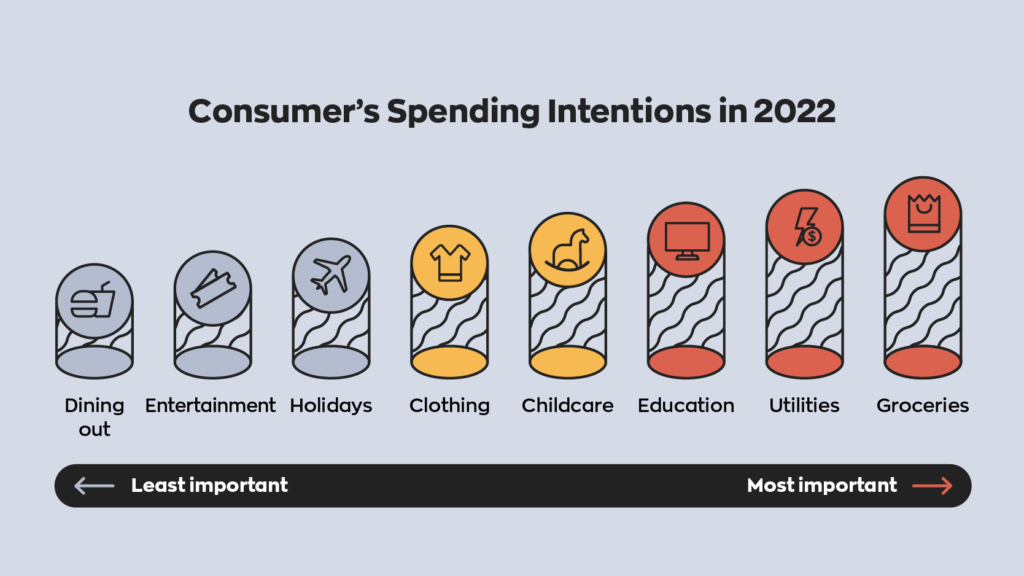

Reports also show that many retailers, such as Walmart, are carrying excess inventory at the moment. It’s thought that this is a result of inflation which sees customers spending more on low-margin food items rather than general merchandise.

However, a change in shopping habits isn’t always linked to inflation. Other recent reports suggest that customers are now buying different types of products in a post-pandemic era. For instance, Macy’s was recently left with a surplus of casual clothes and activewear as shoppers instead bought clothes to wear for the office or social events.

Keeping a close eye on both your business and the current market will help you spot trends and stay adaptable when it comes to ordering inventory especially during a recession.

Should I cut back on inventory during a recession?

Unfortunately, there is no easy answer. Your strategy depends on your business. Instead, let’s take a look at what other companies are doing.

In response to rising inflation, Gartner found around 33% of manufacturers and retailers are currently reducing their inventory, while over 40% are increasing it to protect against shortages. Why might they have chosen these strategies?

Advantages of reducing stock levels

In a downturn, inventories can build up as sales slow. Customers may have less money to spend on nonessential items, while prices also increase. Holding large amounts of excess inventory can cause problems going into a recession.

Carrying inventory costs money that cannot be invested in other areas and doesn’t leave room for flexibility in a changing market.

Find out how to calculate carrying costs in our recent article.

Advantages of raising stock levels

Sometimes, having extra stock can help your business grow, as Forbes explains. Imagine one company has supplier issues and can’t fulfill orders. Customers will likely turn to a competitor who can. Their extra stock can now be sold, cementing new business relationships.

Finding the balance

Order too much, and you could be faced with excess inventory that’s impossible to shift. Order too little, and you could be faced with stockouts. Whichever tactic you settle on, make sure to plan ahead, monitor the market, and do your research.

Making money during a recession

Although it presents a challenge, making money during a recession or downturn isn’t impossible. Of course, each recession will look different, and retail is constantly evolving. But learning from the past can help us plan for the future.

Towards the end of The Great Recession (2007-2009) the Harvard Business Review published an article with five rules for retailing in a recession. Rule two of the article is called: Close the Needs-Offer Gap. In short, this is about getting more customers to shop at your store by offering them what they want.

This sounds simple, but it’s easy to miss the mark. Businesses are often inclined to base sales and inventory strategies on what sells in their stores, not what sells in competitors’ stores. Perhaps they analyze historical data or track what’s selling day to day.

However, this shows you what is selling, not what could be selling. Understanding the needs-offer gap means working out what your potential customers are getting elsewhere in terms of products, services, and experiences, and then offering what they’re looking for in your store. Today, that store might be physical or online.

What does a recession-resilient company look like?

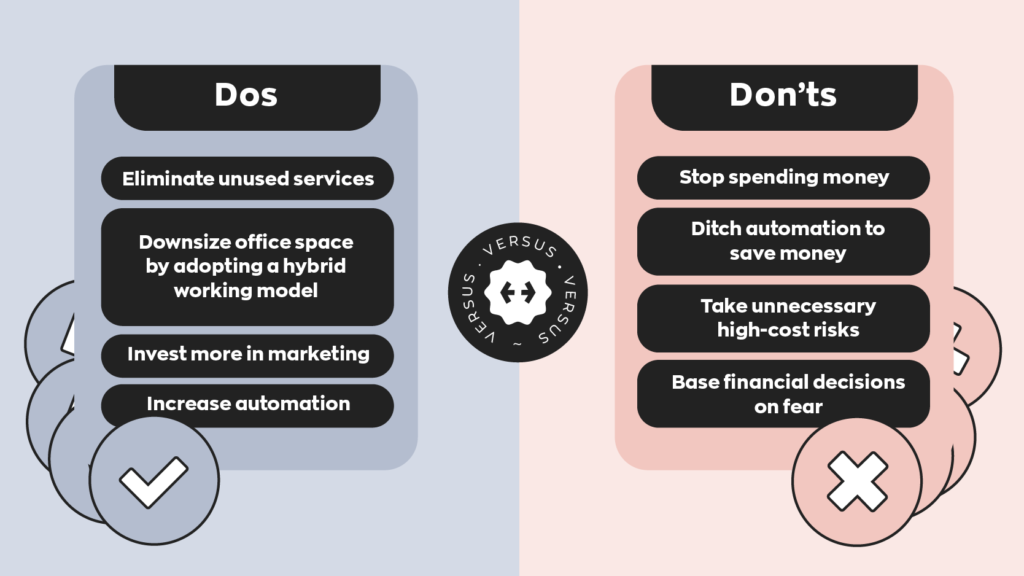

Recent McKinsey research looked at companies that fared well in the last recession: what did they do to survive and how did they do it?

They found that, before the downturn, resilient retailers took important steps that meant they could stay adaptable. The six actions that set them apart were:

- Building cash reserves

- Creating margin headroom

- Going on the offensive

- Moving into new markets

- Reshaping the value proposition.

- Maintaining customer service

Sometimes, this meant taking unexpected but decisive action. For example, T.J. Maxx decided to increase advertising spending by 15% to reach customers outside its core. By 2009, 75% of its customers had not shopped there the year before.

While you might think it makes sense to cut back on spending and inventory during a recession it may not always be the smart decision. It’s all about knowing what adds the most value to your business and scrapping the things you can live without.

The importance of staying up to date

However you choose to weather the downturn, there is no one-size-fits-all approach. Staying on top of what’s happening in your business and the current market will help you make the right decisions.

For more information on inventory management methods, have a look at our latest articles.

0 Comments