Deciding how much to sell products for is a delicate balancing act. On one hand, a business needs to make a good profit, but on the other, the price tag still needs to attract customers. Today we’re delving into how to use the selling price formula to work out prices and what it means for your business.

So, what is selling price?

A selling price is the amount your customer pays for a product or service. This is different from the cost price, which refers to how much a product costs your business (not the customer). For your business to turn a profit, products need to sell for more than they cost.

What factors affect selling prices?

There are many factors that affect the selling price of a product, including the common ones below:

What your buyers will pay

How much a potential customer is willing to pay for your product depends on factors such as its quality and market value. This is where you need to consider your positioning within the market. A brand that is perceived as higher end means your customers will be willing to pay more for your offerings.

How much you, as a seller, will accept

The cost of a product isn’t just what you paid for it. When calculating your selling price you should take things such as shipping fees, labor, and more into account. Ultimately your business needs to turn a profit, and all these expenses add up.

The current market

Factors outside your business can affect what you can charge for a product. For example, in case of high demand, you may be able to charge more. Meanwhile, if a competitor floods the market with their products, you may find yourself dropping your selling prices in order to retain customers.

What is the selling price formula?

You can calculate a product’s selling price by adding its cost and your desired profit margin together. So, the formula looks something like this:

Working out your costs

In the selling price formula, cost is how much your business spends on a product. These figures will vary depending on your business model. For example, a retailer who buys a product and a manufacturer who makes a product in-house will have different costs.

Knowing which factors you have included in the cost of your product will help you keep a close eye on your profit.

For more information on working out costs, have a look at our recent cost of goods sold (COGS) article. We know it can be a pain to keep all of these formulas straight. So we decided to create a handy Inventory Formula Cheat Sheet with 7 of the most common inventory formulas.

Download your inventory cheat sheet now!

Is there a standard selling price?

In this section, we’ll be discussing both profit margins and markups. If you’re not sure how to calculate either of these, check out our quick guide to margins and markups.

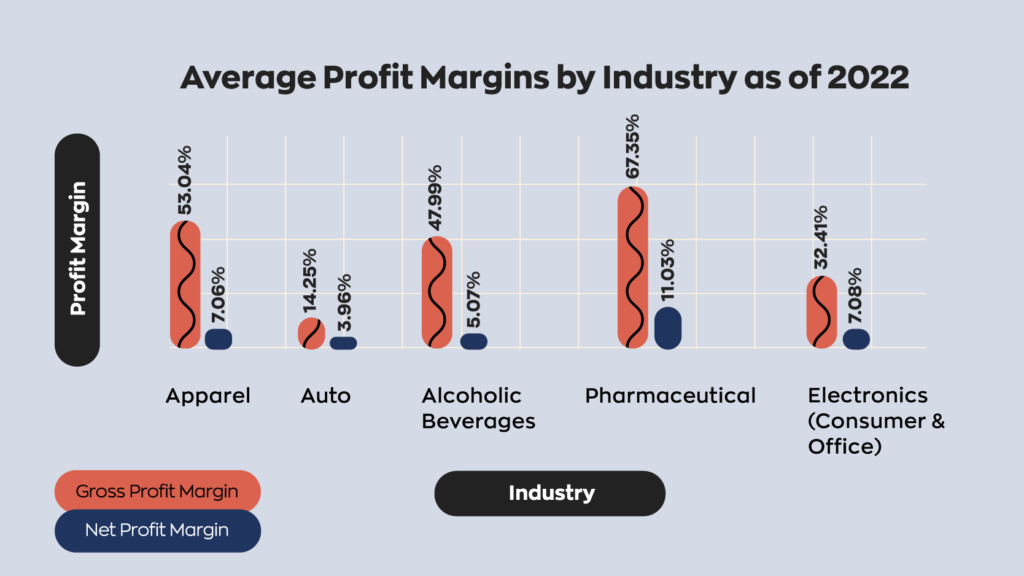

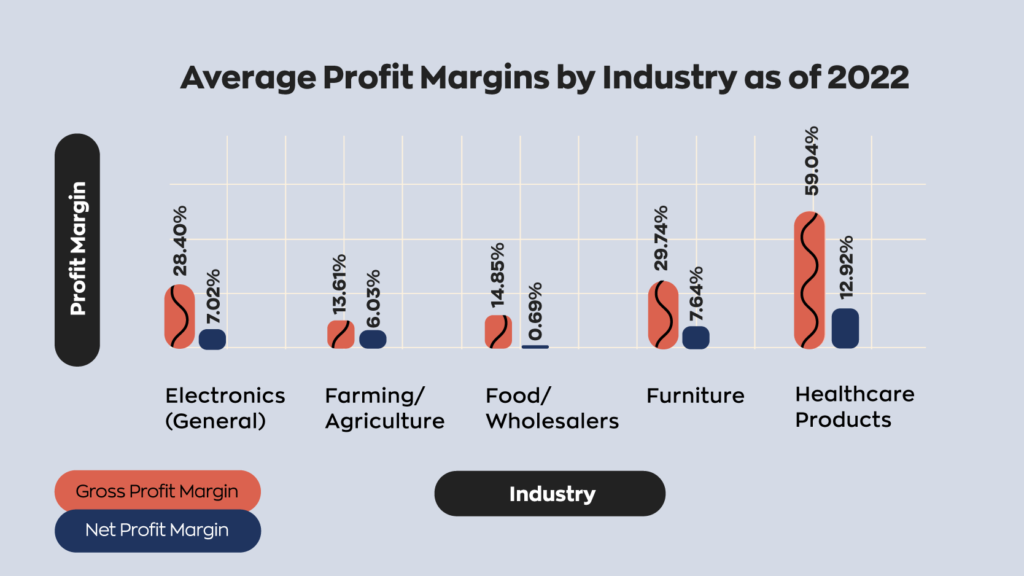

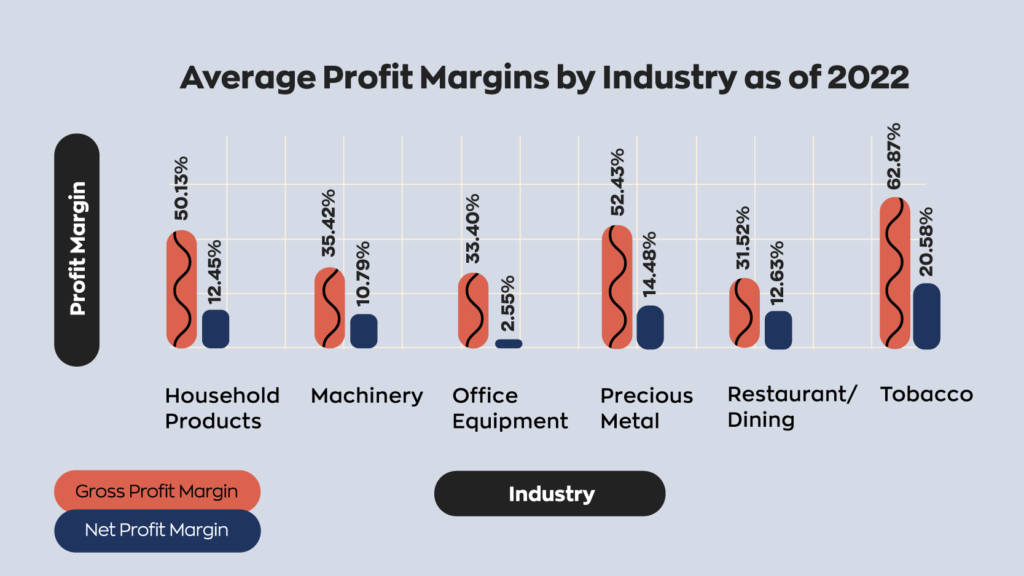

Because each product has different costs, a standard selling price would really equate to a standard profit margin or markup. You might hear about rules like the 25% markup, but healthy profits can look different across industries and even between competitors with different business models.

As the Business Development Bank of Canada explains, “on the face of it, a gross profit margin ratio of 50 to 70% would be considered healthy for many types of businesses”. However, service industry businesses like legal firms may consider a 50% profit margin quite low.

With this in mind, it’s important to work out a pricing strategy that works for your business, one that covers direct and indirect costs and helps you turn a healthy profit.

What is average selling price (ASP)?

The price of a product can change for many reasons. Start-ups might offer lower prices to attract new customers, or shortages might create a sudden demand which can hike prices. You may also have run a promotion which temporarily brought the prices down.

Whatever the reason, changing prices can make it harder to keep an eye on which products work best for your business. That’s where average selling price comes in.

Average selling price tells you just that: how much a type of product has sold for, on average, in a given period.

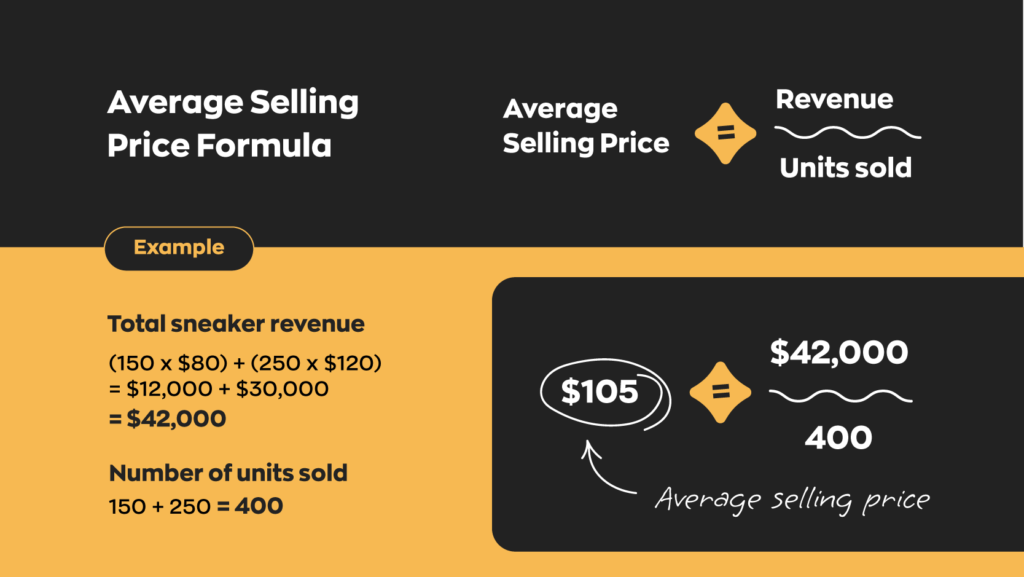

How is average selling price calculated?

To find your average selling price, simply add up the total revenue and divide by the number of units sold. You might do this for a single product or a range.

Let’s see an example of how that works.

A sneaker retailer wants to find out the average price of their best-selling style. The local area has a large college, so the store owner often puts on promotions to attract students at the start of the semester.

This means that, in Q3, the store sold 150 of these sneakers at $80 and 250 at $120. Let’s break down the total sneaker revenue and average selling price in this example.

How can you use average selling price?

You might use data about average selling prices to work out how your prices compare to your competitors. You can also use them to analyze trends across the market and within your own company.

Average selling prices can also help business owners analyze how products sell on certain channels. For example, when retailers list a product via platforms like Google Ads, they can see the average price other merchants sell that product for. As Google explains, this helps you check if your price is competitive, develop strategies, and understand your products’ performances.

Of course, the average selling price is more stable for certain products. Some products have a shorter life cycle than others. For example, a smartphone will go down in value when a newer model comes out, but a classic breakfast cereal is more likely to remain stable.

Maximizing profits through inventory control

Having the right selling prices is a key component of a successful business. But increasing the selling price isn’t the only way to boost profits. Improving the way your business handles and manages inventory can lower your costs.

This could include everything from how you track your assets, to efficiently scanning deliveries, organizing your warehouse, and more. To find out more, have a look at our inventory management articles or see how inFlow’s all-in-one software could help boost your business.

0 Comments