Effective inventory valuation and management is vital for the success of many organizations. Not only does that data give information on what changes or tweaks a business needs to make, but it’s also crucial for tax reporting purposes. Incorrect or lazy valuation can cause businesses to pay higher fees, hurting their bottom line.

With that in mind, it shouldn’t come as a surprise that small businesses always look for effective methods to keep track of inventory. Two of the most common costing methods are first in, first out (FIFO) and last in, first out (LIFO).

There are several key differences between LIFO and FIFO that are important to understand before making a decision.

Key differences between LIFO and FIFO

The key differences between LIFO and FIFO include:

- Accounting Impact: LIFO can result in lower net income and lower taxes during inflation as older, cheaper costs are matched against current revenues, and FIFO can result in higher net income and taxes as older, cheaper costs are sold first, reflecting current price levels.

- Inventory Valuation: Using, LIFO the ending inventory may be undervalued as it reflects older costs. Meanwhile, using FIFO the ending inventory tends to be valued higher, representing current market conditions.

- Usage: LIFO is common in companies aiming for tax benefits during times of rising prices, but not permitted under IFRS, while FIFO is widely used across industries and accepted under both GAAP and IFRS.

In short, FIFO is more widely used, but LIFO can also have its benefits in certain contexts.

Businesses that could benefit from using FIFO

Here are some businesses that could significantly benefit from implementing the FIFO inventory management method:

- Perishable goods retailers: Supermarkets and grocery stores benefit as FIFO ensures older stock sells first, minimizing spoilage and waste.

- Fashion and apparel stores: Keeps stock fresh and aligns with fluctuating fashion trends, preventing outdated inventory.

- Pharmaceutical companies: Ensures that medicines with expiration dates are used in time, maintaining safety and compliance.

- Tech and electronics retailers: Helps manage the rapid obsolescence cycle by selling older models first.

Overall, adopting the FIFO method allows these businesses to maintain optimal inventory levels, reduce waste, and improve customer satisfaction by ensuring that products are always fresh and relevant.

Businesses that could benefit from using LIFO

However, other businesses may get more benefits from implementing the LIFO inventory management method:

- Commodities traders: Businesses dealing with goods like oil, metals, and grains might use LIFO during inflation to match recent purchases with current selling prices, reducing taxable income.

- Large manufacturing firms: Companies with high production costs can reduce taxable income by expensing the latest and typically higher inventory costs first.

- Retail chains with non-perishable goods: Helps control profits by managing cost of goods sold when prices inflate, useful for tax advantages under certain regulations.

- Hardware suppliers: Typically see less frequent price drops, allowing them to strategically manage profit and inventory metrics.

Each method provides distinct advantages depending on how businesses manage their inventory cost, taxation strategy, and market dynamics.

What is inventory valuation?

As the name suggests, inventory valuation is the business practice of assigning a monetary value to existing inventory. And although that sounds simple, there’s a lot more at stake than just FIFO or LIFO. It also carries some legal ramifications. For example, the IRS asks that companies stick to one valuation method for their first year of operation, and they must ask permission to make changes in subsequent years.

FIFO vs. LIFO: Why do they matter?

Outside of legal requirements, a business’s inventory costing method directly reflects its potential profitability. This is because the way that a business values its inventory has a direct effect on different data points. This includes the cost of goods sold (COGS), which will impact how you price your products and services. These figures also affect a business’s plans for the year and can influence external investment decisions as well.

LIFO vs. FIFO: what’s the difference?

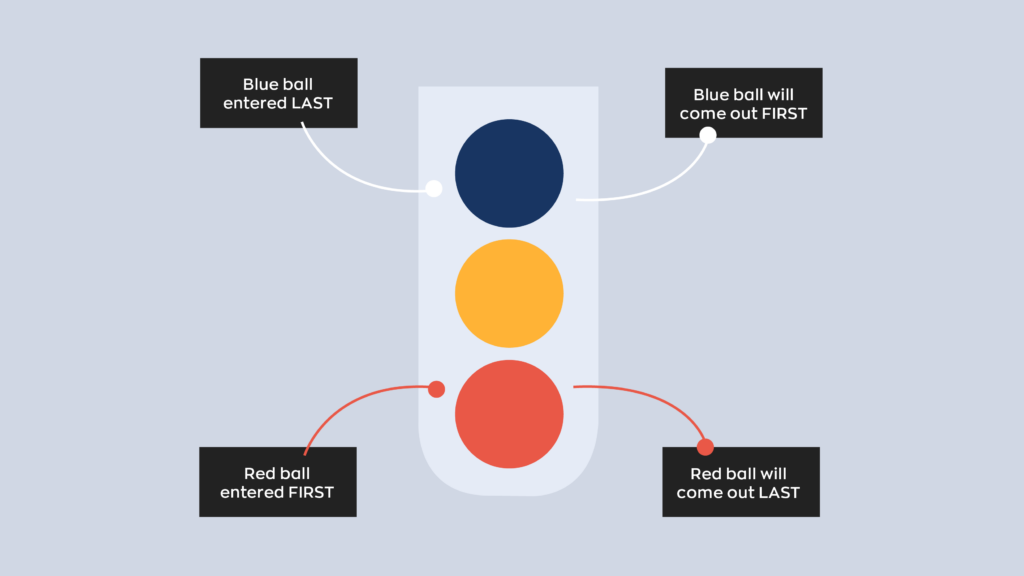

Before we address the differences in FIFO and LIFO for inventory valuation, it’s helpful to have a working comparison — in this case, for the flow of inventory.

Think of it as a rotating door. Ideally, there’s a steady stream of products moving in and out simultaneously. But there’s only so much room, meaning you’ll have to be selective with the order in which you move product out. That’s where the difference between FIFO and LIFO lies.

FIFO inventory method

A business using the FIFO inventory method prioritizes selling its oldest product units first. Following this model, they also calculate the net worth of that product unit using the most recent price.

Here’s an example. Let’s say that a bath company purchases 1,000 bars of soap. At the time of purchase, each one has a selling price of $5. At the end of the season, they have 250 bars left, but they restock to prep for the busy season. They purchase another 1,250 bars, this time at $7 per bar. At the end of the busy season, they have 200 bars left. This means that they sold 1,300 bars during the busy season.

Using the FIFO inventory method, the bars valued at $5 were sold first. The $7 bars are allocated to their remaining inventory. Therefore, under the FIFO costing method, the bath company now has $1,400 in remaining inventory.

LIFO inventory method

A business using the LIFO inventory method does the opposite. Instead of calculating these figures using the oldest units, they use the value of the newest unit. Let’s re-use the same figures from above to illustrate this.

The business still has 200 bars left. Using the LIFO costing method, the first bars of soap sold were valued at $7. Therefore, the remaining 200 are valued at $5. Under this model, the business now has $1,000 in remaining inventory. Of course, there are more models in use than just these two. So, let’s take a look at average cost.

Average cost

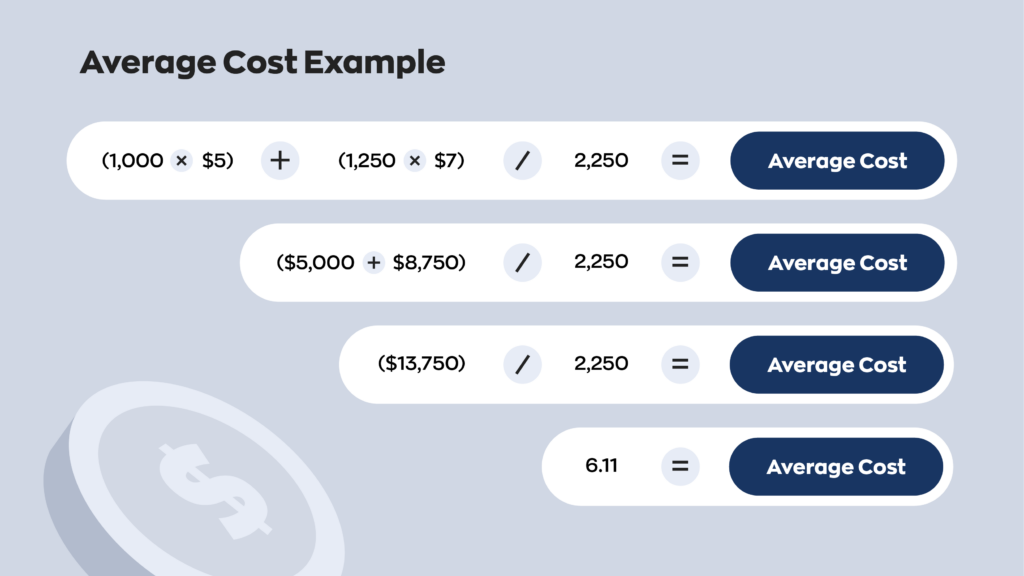

A business using the average cost model does things differently than FIFO and LIFO. They consider price changes by calculating each unit’s average cost. This model involves a bit more number crunching, so here’s what it looks like using the numbers from the example above.

And there you have it. The average cost for the bars of soap in our example would be $6.11 per unit.

Is LIFO legal?

The most important thing when deciding which valuation method to use for reporting is whether LIFO is legal. That might sound like an exaggeration, but it’s not. The IFRS bans the use of LIFO accounting in Europe.

The only major country that allows LIFO accounting is the U.S. This is because the U.S. uses a different accounting standard, the Generally Accepted Accounting Principles (GAAP). Many countries ban LIFO because of the tax implications, as LIFO accounting minimizes reported profits. In many cases, this directly leads to less income tax. Even if LIFO is legal in your area, however, it may not be suitable for you.

Why use LIFO

When deciding between FIFO and LIFO, it’s also important to note that the LIFO inventory method is more difficult to manage overall. It requires businesses to collect more data and maintain highly accurate records.

Despite the added difficulty, however, LIFO does have its benefits. The same reason that it’s disallowed under the IFRS is the same reason businesses use it. Because LIFO typically reports a lower net income, businesses pay less income tax. This directly increases their overall revenue.

The LIFO inventory method also helps businesses offset the effects of inflation. Because prices tend to rise during inflationary periods, using the newest price for valuation also leads to lower net income — which, of course, lowers income tax.

FIFO vs. LIFO: Which one is right for you?

The most glaring issue of LIFO is that it requires businesses to hold onto their oldest product units for extended periods. If the product in question is perishable, it risks becoming unfit for sale. As such, business owners should consider the nature of the products they carry. A grocery store, for example, is better off using FIFO rather than LIFO.

Businesses that sell non-perishable goods, such as computers, are likely better off using the LIFO inventory method, mainly because these items tend to be of a high individual cost. Whichever method you use, be sure to research all your available options first. You should also consider talking with your accountant for better insights and to make the best decision for your organization.

0 Comments