This is a blog post about our older, locally-installed product, inFlow On-Premise.

It does not impact inFlow Inventory’s availability.

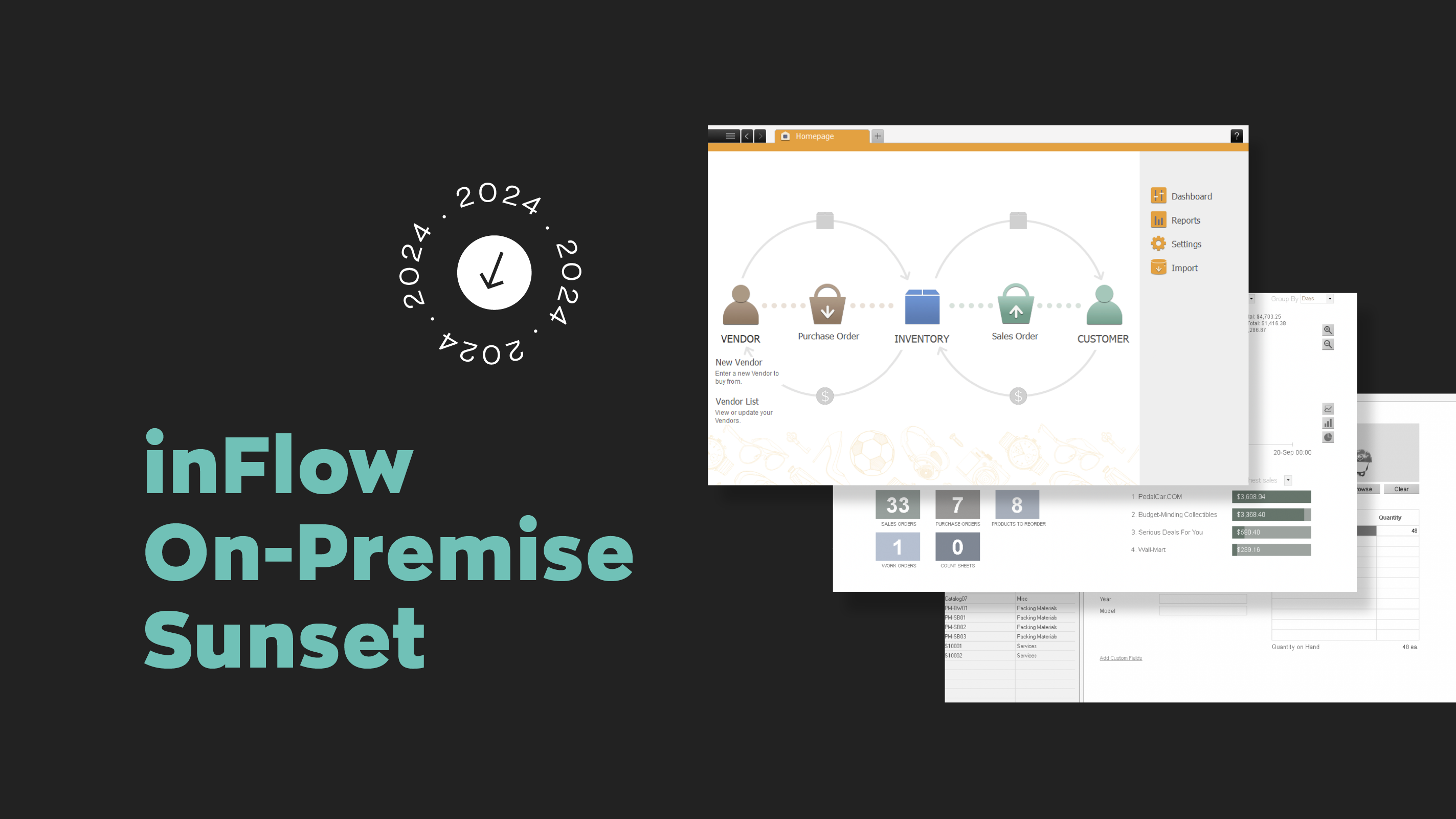

We’re announcing our plans to sunset inFlow On-Premise on July 31, 2024.

That’s two years from now.

After July 31, 2024 we’ll stop selling or activating new licenses for inFlow On-Premise and stop providing support (including online KB articles).

In some circumstances, you may be able to continue using inFlow On-Premise on computers that already have it installed. This KB article explains how you could continue using On-Premise after sunset.

Our reasons for sunsetting

This was a tough decision to make, and we wanted to let you in on the thinking behind it.

We’re a small business ourselves—about 50 people strong. Since 2007 our mission has always been to help small businesses grow by overcoming inventory problems.

Those problems have changed over the past 15 years. Most businesses now sell across multiple physical and digital channels, and we’re putting a lot more smartphones to work in lieu of paper.

Those changes led us to launch inFlow Inventory in 2017, which offered apps on Android, iOS, and web, and a new technological foundation to help you move faster.

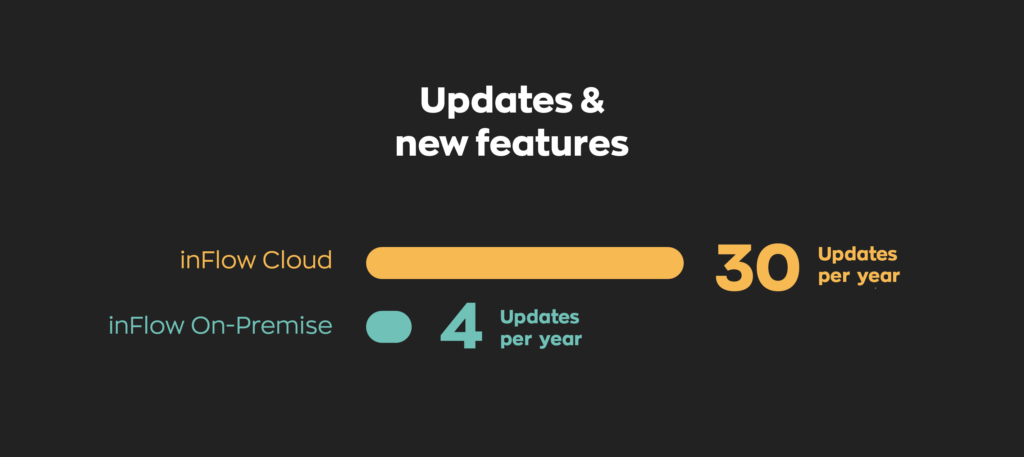

Looking back, we’ve delivered new updates seven times faster than before. We’ve accomplished things that weren’t possible within the limits of our On-Premise technology—like a built-in B2B Portal and over 90 integrations.

So we’ve decided to shift all of our focus to inFlow Inventory, and we’ll do that on July 31, 2024.

How can you plan ahead?

We hope you’ll continue on with us, but if inFlow Inventory isn’t the right fit for you, we want you to keep as much of your data as possible. We have guides on how to export your data from inFlow On-Premise in case you need to migrate to a different (non-inFlow) system.

But if you’ve found inFlow On-Premise useful, we believe inFlow Inventory can help you even more. We’ve made it really easy to transfer your On-Premise database to inFlow Inventory. And our team is ready to help with any questions you might have about features, mobile apps, or pricing.

Thank you for supporting inFlow On-Premise over the years, and we hope to continue working with you in inFlow Inventory!

Hi Louis, I have inflow on premise which I love. I have it integrated with Shopify. If I continue to use this past 2024 July will the integration shopify continue to function?

Thanks for your time.

Hi Steve,

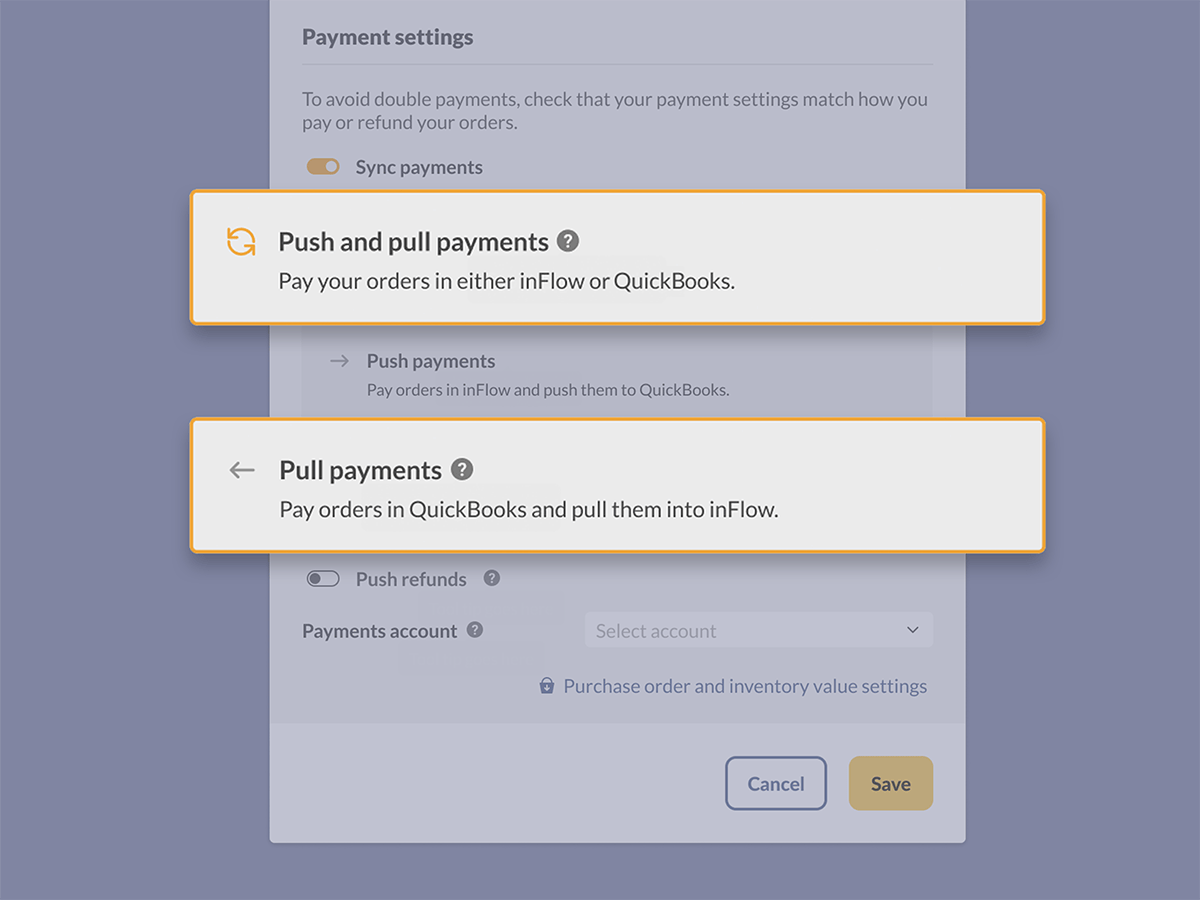

We’re glad you are loving on-premise! Due to back-end changes from Shopify, the Shopify integration in On-Premise may no longer function properly after June 30, 2021. So if it’s still functioning for you it may not work if there are any other updates or changes in the future. You can read more about the Shopify integration with on-premise here. If you’d like to continue with the Shopify integration we would recommend switching over to inFlow Inventory in the future. You can read more about our Cloud integration here and here.

If you need help with anything don’t hesitate to reach out to our amazing support team at support@inflowinventory.com

Cheers,

Jared

If we extend our on-prem license in Jan 2024 are we good until that expires in Jan 2025 using the OAC or will the OAC allow us to use on-prem beyond the license expiry date?

Hey Michael,

The OAC should allow you to use on-prem past the expiry date. However, when inFlow is sunset in 2024, the licensing server will no longer be available. So you will have to create an OAC on your server computer before the sunset date to continue using inFlow On-Premise after sunset. Keep in mind you can’t use the certificate for any other computer. We will take down the licensing server on July 31, 2024, so there won’t be an option to create any new OACs after sunset. Please ensure that the hardware you download the OAC to will be the one you want to continue using inFlow with.

You can read more details OAC and using inflow after sunset in this KB article:

https://onpremise.inflowinventory.com/support/the-sunset-plan-for-inflow-on-premise#Continue-using-inFlow-v3-OAC.

If you have any other questions not covered in the article please reach out to us at support@inflowinventory.com

Cheers,

Jared

We use inflow on premise for one process, and inflow cloud for another. We have been big supporters of your system for well over 10+ years. Will our inflow on premise still be working after 31st July 2024? We understand you will not support it, but we recall purchasing a license that was a one off payment at the time and it would run forever.

HI Daniel,

Yes! You absolutely can continue to use your On-Premise indefinitely, however you will have to take some steps to ensure you can continue using it past the sunset date. When inFlow is sunset in 2024, the licensing server will no longer be available. So you will have to create an OAC on your server computer before the sunset date to continue using inFlow On-Premise after sunset. Keep in mind you can’t use the certificate for any other computer. We will take down the licensing server on July 31, 2024, so there won’t be an option to create any new OACs after sunset. Please ensure that the hardware you download the OAC to will be the one you want to continue using inFlow with.

You can read more details OAC and using inflow after sunset in this KB article:

https://onpremise.inflowinventory.com/support/the-sunset-plan-for-inflow-on-premise#Continue-using-inFlow-v3-OAC

If you have any other questions not covered in the article please reach out to us at support@inflowinventory.com

Cheers,

Jared