Businesses run on cash flow. That’s a simple fact that no one can ignore, not even mega-corporations like Walmart and Amazon. For retailers, this extends to inventory. Put simply, no cash flow means no cash to purchase more inventory, which means no sales. This is why lowering operating costs and improving cash flow is so essential, and the best way to do this is by understanding the numbers. For many business owners, this means relying on powerful formulas like the average inventory formula.

The average inventory formula is a crucial component of many popular inventory formulas. It’s the first step in gaining even more valuable insights into your business. So, what is the average inventory formula?

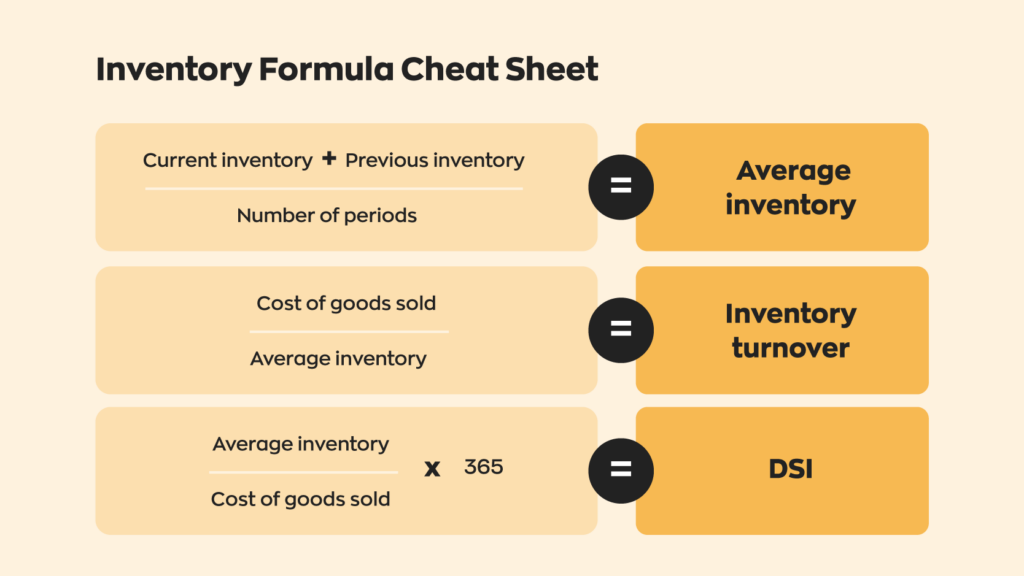

We know it can be a pain to keep all of these formulas straight. So we decided to create a handy Inventory Formula Cheat Sheet with 7 of the most common inventory formulas.

Download your inventory cheat sheet now!What is average inventory?

Before talking about the formula itself, it’s important to understand what average inventory is. The retail space is a seasonal industry through and through. This has a lot of effects on business, one of which is irregular sales. In extreme cases, one month’s sales could be exponentially more than the previous month’s. Again, this is an extreme case, but it’s not uncommon, either. Different seasons cause different products to be in demand, and sometimes a product just randomly becomes “trendy.”

For example, coastal regions won’t sell much beach equipment during autumn or winter. They’ll sell some, sure, but only a little. And then, once summer rolls around, they’ll sell a lot more. Both to locals looking to replace worn gear and tourists looking to beat the heat.

These irregular sales create outliers in financial data that can be difficult to work with. Average inventory seeks to rectify this by smoothing the numbers, giving more consistent data that’s easier for experts to work with. Instead of looking at each data point individually, you’ll compound them and calculate the average according to time elapsed.

What is the average inventory formula?

It sounds complicated, but it’s pretty simple! This is what the average inventory formula looks like:

(Current inventory + Previous inventory)/Number of periods = Average inventory

Something to note; the average inventory formula uses current inventory as a data point. That means you’ll have to account for that when dividing by the number of periods. Now, let’s see the average inventory formula in action!

How to calculate average inventory

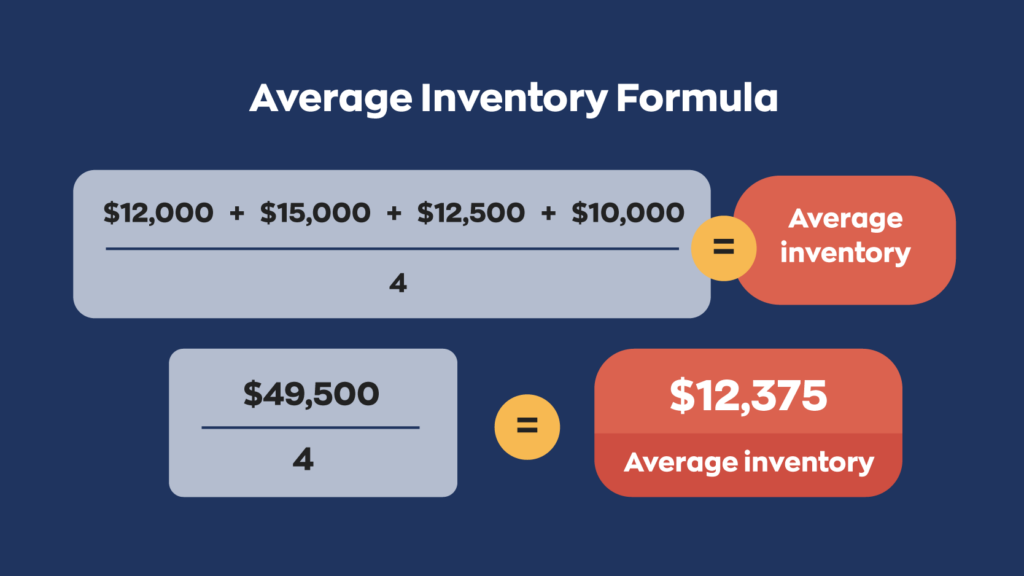

For this example, let’s pretend that you own an electronics store. It’s the end of the month, and your current inventory in the warehouse is worth $12,000. Suppose you want to calculate the average inventory for the past four months. Your inventory for the three previous months was $15,000, $12,500, and $10,000.

Using the average inventory formula, you’ll add all three figures together and divide by 4.

And that’s it. That wasn’t so hard, was it?

Limitations of the average inventory formula

Unfortunately, this is just one number at the end of the day. It doesn’t paint the whole picture, but it can help you consider different inventory management strategies. The average inventory formula is valuable because it can simplify your data into one digestible number.

While “smoothing the curve” can be a good thing, it’s also a bad thing. Because it uses an average value, it eliminates all the outlier data points that can often tell you a lot. Some products will sell better than others. That’s just the nature of doing business. The average inventory formula eliminates those individual figures, which also eliminates additional information.

Of course, there are ways to circumvent this. You can calculate the average for each individual SKU, for example. Considering the simplicity of the average inventory formula, this is relatively easy, too. But while it gives a more accurate picture, it’s not always ideal for businesses with many different products.

For instance, if you carry 5-10 products, you could easily use the average inventory formula for each SKU. But what about when there’s 100 or even 200 products? The more products you’re dealing with, the less likely you will use the average inventory formula for each of them.

What can I use average inventory formula for?

That doesn’t mean that the average inventory formula is useless, though. Far from it! In fact, average inventory plays a big part in two other inventory formulas that are widely used by businesses, big and small. Those two formulas are days sales of inventory and inventory turnover ratio.

- Days sales of inventory (DSI) attempts to inform businesses of how many days it takes to convert inventory to sales. In simple terms, how long it takes to sell off your inventory. It’s a useful figure that can help inform businesses where they can improve and cut carrying costs. The DSI formula looks like this:

(Average inventory/Cost of goods sold) x 365 = Days sales of inventory

- Inventory turnover ratio measures how fast you sell your products during a specific timeframe. A high turnover indicates a healthy flow of goods, while a low turnover rate can signal that sales are slow or that you’ve overstocked. The inventory turnover formula looks like this:

Cost of goods sold/Average inventory = Inventory turnover

In brief, the average inventory formula on its own is pretty limiting. But when used in conjunction with other inventory formulas, you start to see its importance.

How does the moving average formula factor in?

The market is always moving. For retailers, that means their restock costs will vary from month to month or even week to week. In extreme cases, this can make the average inventory figure irrelevant or even harmful.

That’s why it’s essential to know the moving average formula. You can calculate moving average by dividing the total cost of your current inventory by the number of units in a given time period. With this formula, you have a better understanding of what each unit costs on average over time.

The software that can help

While the data you get from the above formulas is valuable, they also demand accurate information on your end. That’s why having proper systems in place is so important. A perpetual inventory system like inFlow gives you all your company’s data right at your fingertips.

Our software can even take care of some of the math for you! You simply set up your products with whatever costing method suits you, like moving average, and you’re smooth sailing.

0 Comments