Two weeks ago we talked about getting the cost value of your inventory and last week about reviewing outstanding orders. This week, we’ll be looking at pulling your total purchases and total sales for the last year as well as your related tax info. You certainly don’t have to start pulling your financials right away (as tax season is quite a ways away), but it’s a good idea to know how it will be done once you get there.

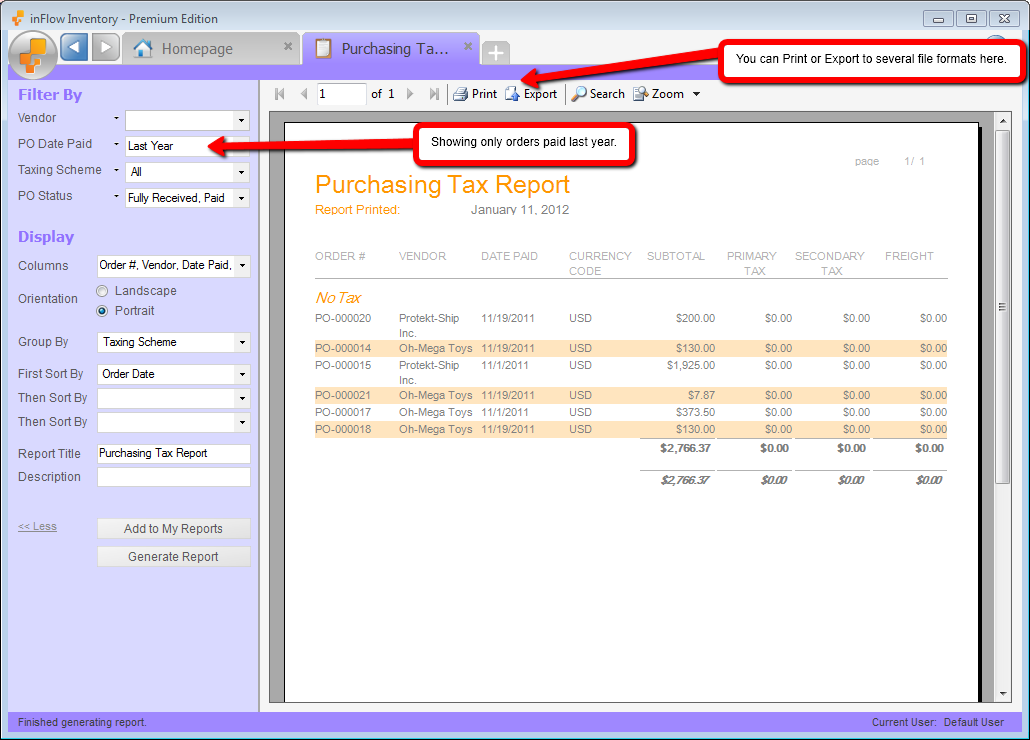

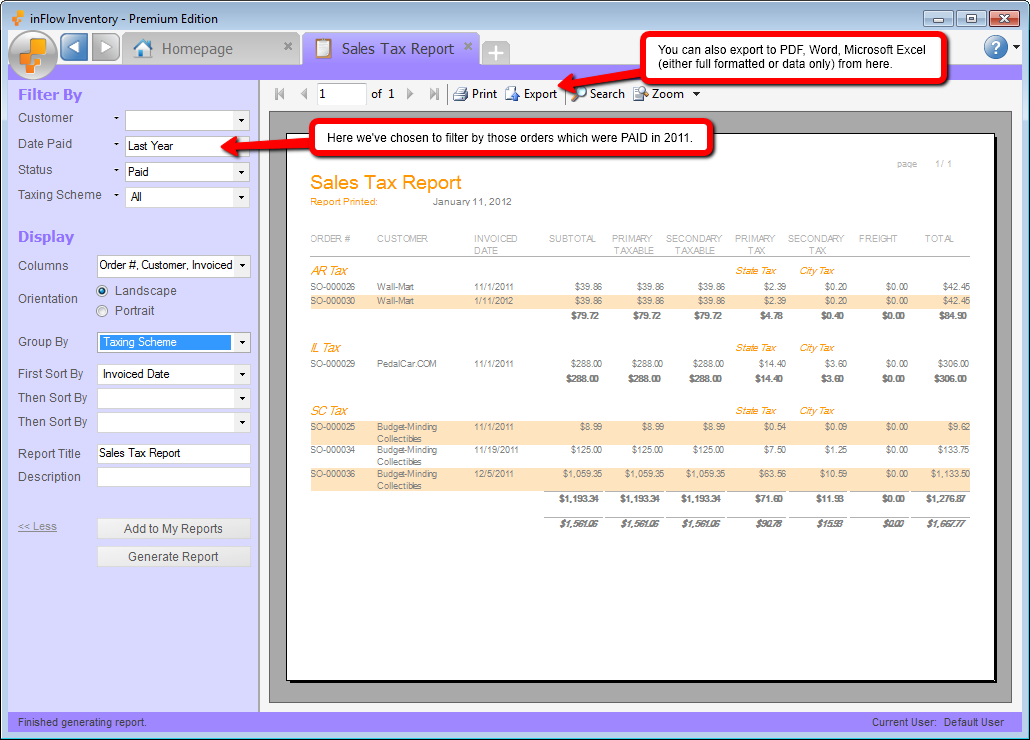

There are two reports that will particularly careful as you are preparing your tax statements and those will be the Purchase Tax Report and Sales Tax Report. They are both accessible via the Report List (Main Menu > Reports > Report List) and can be found in the Purchasing Reports and Sales Reports sections respectively.

Purchase Tax Report: This report gives you a breakdown of all the purchases you’ve made within a certain period and allows you to see how much tax you’ve paid to your vendors as well. In the example below the company has paid no sales tax for the period in question.

Sales Tax Report: This report gives you a breakdown of all the sales you’ve made within a certain period and allows you to see how much sales tax you’ve collected over the year. In the example below, the company has collected tax for different taxing schemes depending on the customer and the system has grouped them accordingly.

If you have a time saver you’d like to share, send it our way at support@inflowinventory.com. If your suggestion is chosen your name and a link to your website will be shared.

0 Comments