Love or hate them, it’s impossible to deny the popularity and influence of Amazon. Not just for consumers but for sellers as well. But now, in 2023, Amazon has announced that they will add additional Amazon selling fees for merchants not using their fulfillment by Amazon (FBA) program. While this new fee isn’t active yet, merchants are scrambling to crunch the numbers to see if they should make the switch or find other alternatives.

While this announcement will draw FTC’s attention, it’s something that merchants are going to have to deal with- and soon. So, what does this Amazon news really mean for sellers? How will this affect the Amazon marketplace charge?

Let’s find out.

Amazon FBA sellers vs. FBM sellers

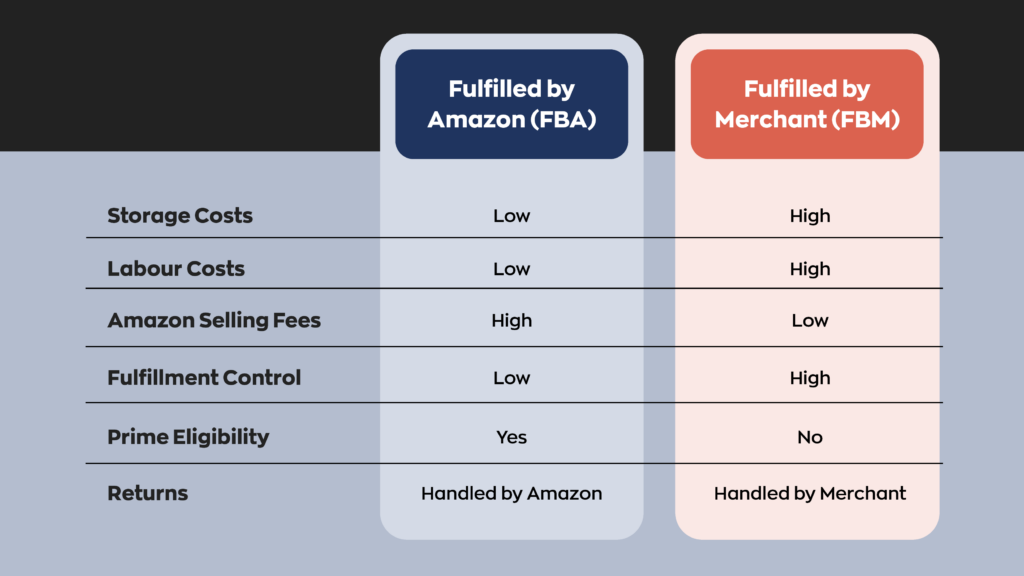

Every merchant on Amazon falls into one of two categories. They’re either an Amazon FBA seller or a fulfilled by merchant (FBM) seller. They both market (and sell) their products on the Amazon platform and pay Amazon selling fees. There’s one significant difference, though.

An Amazon FBA makes sales through Amazon but lets Amazon handle most of the logistics. This means that Amazon handles packaging, shipping, customer support, returns, and even inventory storage. In return, merchants using the FBA service pay a fee per unit, depending on the product size and weight. This is in addition to the standard Amazon selling fees. FBA can also handle peripheral processes like invoicing.

An FBM seller, on the other hand, handles sales and logistics on their own. This means they’ll package, ship, provide customer support, process refunds, etc. A good way to think of it is that FBM sellers use the Amazon platform for its reach. This doesn’t mean they’re exempt from Amazon selling fees, however– far from it.

Which of these selling models is better?

Neither of these sales models is better than the other. At the end of the day, Amazon is a business first. They apply an upcharge to the FBA service to profit from it. This means determined sellers can save money by handling all the logistics themselves, often with the help of other software and services. And for those sellers who already have their logistics in place, it only makes sense to opt out of FBA.

The FBA program isn’t without merit, however. The most obvious benefit is the hands-off nature of being an Amazon FBA seller. Instead of doing everything yourself, Amazon does it instead! On top of that, FBA is especially helpful for international sellers. They can store products in FBA warehouses, which helps with both shipping times and storage fees.

This has been the dynamic of FBA vs. FBM for a while now. Use FBA to eliminate the hassle; use FBM to save money. But with the recent Amazon news, that might be changing soon.

How are Amazon fees changing?

In 2023, Amazon announced they’ll implement a new fee for FBM sellers. Set to go into effect on October 1st, 2023 (just a month away at the time of writing), FBM sellers will have to pay an additional 2% on each sale.

That doesn’t sound like much, but it adds up quickly. This is also on top of already existing Amazon seller fees. The Amazon referral fee, for example, already takes a portion of all sales values– usually between 8-15%. Therefore, businesses can be left with as little as 83% of their total sales when you compound that with this new fee. And that doesn’t even consider other business costs, fees, or taxes!

For example, let’s pretend your bread-and-butter product is a $50 item. That 15% fee is already $7.50. Add in the new 2% Amazon selling fee; now the total fee is $8.50. That already brings the total value down to $41.50.

That isn’t necessarily a significant loss on its own, but you need consider that this is a per-item fee. If you sell 25 of those products, Amazon takes $162.50. If you sell 50, that number goes up to $325, and so on. Over time, it could add up to thousands, tens of thousands, even hundreds of thousands or millions.

While merchants look into alternatives and crunch numbers, another question has arisen: Is this legal?

Can Amazon raise selling fees legally?

To put it simply, we don’t know. Amazon is a service, and as a service, they have a right to deny access to their service. At the same time, Amazon is no stranger to antitrust scrutiny, and this new round of Amazon seller fees will surely attract the FTC’s attention.

For now, though, sellers will have to deal with it. Cases like these can take years to work out. And even then, there’s no guarantee that the FTC will rule against Amazon– or take any action at all. In short, hope for the best, but prepare to pay the Amazon selling fees.

That leaves FBM sellers with a few options. Become Amazon FBA sellers, eat the fees, or find alternatives.

Should you pay the new Amazon selling fees to opt out of FBA?

As much as we’d love to, we can’t tell you where to go from here. Doing so would require intimate knowledge of your business and a lot of number crunching. What we can do is offer some ideas.

Amazon selling fees suck. There’s no getting around that, and this new one is no exception. Unfortunately, losing Amazon sales would be a massive blow to any business– aside from other retail titans like Wal-Mart. That means that you have three options. Make the jump to FBA, eat the additional 2% fee, or find an alternative.

If you do decide to make the jump to FBA, make sure you’re in compliance before doing so. In particular, make sure to familiarize yourself with Amazon’s barcode system. To make sales through FBA, you’ll need Amazon standard identification numbers (ASINs) for your products. Amazon recognizes GS1 barcodes, but selling via FBA requires using Amazon-specific barcodes.

If neither option is appealing, you’ll have to look for alternatives. Luckily, while they may lack the reach of Amazon, there’s no shortage of competitors. Shopify, for example, continues to grow in popularity. If you decide to migrate your shop, it may be best to run both side-by-side and compare numbers beforehand. Even if you’re determined to leave Amazon, you may need to change processes and cut corners to remain afloat.

More specialized sales platforms are also available– like inFlow’s showroom, for example. It’s oriented more towards wholesalers trying to reach retailers, but if applicable, you’ll have an easier time building business relationships.

What to expect from the new Amazon FBA opt-out fee

There’s a good chance that the FTC will somehow involve itself. While small, these new Amazon selling fees punish users who want to control their own shipping and logistics. Amazon should be allowed to offer their service, but no one should forced into using said service. This sort of anti-competitive fee is precisely what legislation aims to avoid.

At the same time, even if the FTC does step in, these sorts of civil suits take time. Sometimes years. For now, come October, you’ll have to deal with the new Amazon selling fees, and it’s best to prepare.

0 Comments