Key takeaways

- The US introduced a 10% tariff on all imports from April 5, 2025, including UK exports.

- UK economic growth is expected to slow, with sectors like automotive, steel, and pharmaceuticals most affected.

- SMBs trading with the US face tough decisions on pricing, as absorbing or passing on costs impacts competitiveness.

- Tariff rates are based on the product’s country of origin, determined by where substantial transformation occurs.

- Basic packaging or labelling in the UK does not qualify as transformation under US rules.

- Clear documentation is essential to prove origin and avoid delays, fines, or rejection at customs.

- Tariffs add pressure across supply chains, from supplier reliability to stock management and fulfilment.

- Smarter inventory planning and tools like inFlow can help businesses stay organised, resilient, and informed.

There’s been a lot of hullabaloo in the news recently about tariffs, and for good reason. On April 5, 2025, the United States rolled out a new ‘baseline’ tariff of 10% on all imports. Unfortunately, the UK wasn’t exempt from its far-reaching wrath, meaning all UK exports are subject to the new rule. The whole debacle has understandably left many worried about the impact of Trump’s tariffs on the British economy, stirring up questions about how best to mitigate their effects.

In this article, we’ll walk you through the essentials – from what tariffs are, how they might impact your business, and what practical steps you can take to stay ahead.

What is a tariff?

If we take this hotly debated topic and boil it down to its basics, a tariff is simply a tax on goods coming into a country. Governments may use tariffs in an attempt to protect local industries by making imported goods more expensive. The idea is to encourage people to buy local products instead of imported ones.

However, for businesses, tariffs mean higher costs, tighter margins, and possible changes in how and where you source, produce, or sell.

How will US tariffs impact the British economy?

While no one has a crystal ball (that we know of, at least), experts across the board paint a rather gloomy picture. It’s expected that tariffs will challenge our economic growth, undermine our sectoral stability, and threaten global trade dynamics. According to KPMG, British national GDP growth could decline between 0.8% and 1% for 2025 and 2026, down from earlier forecasts of 1.5%.

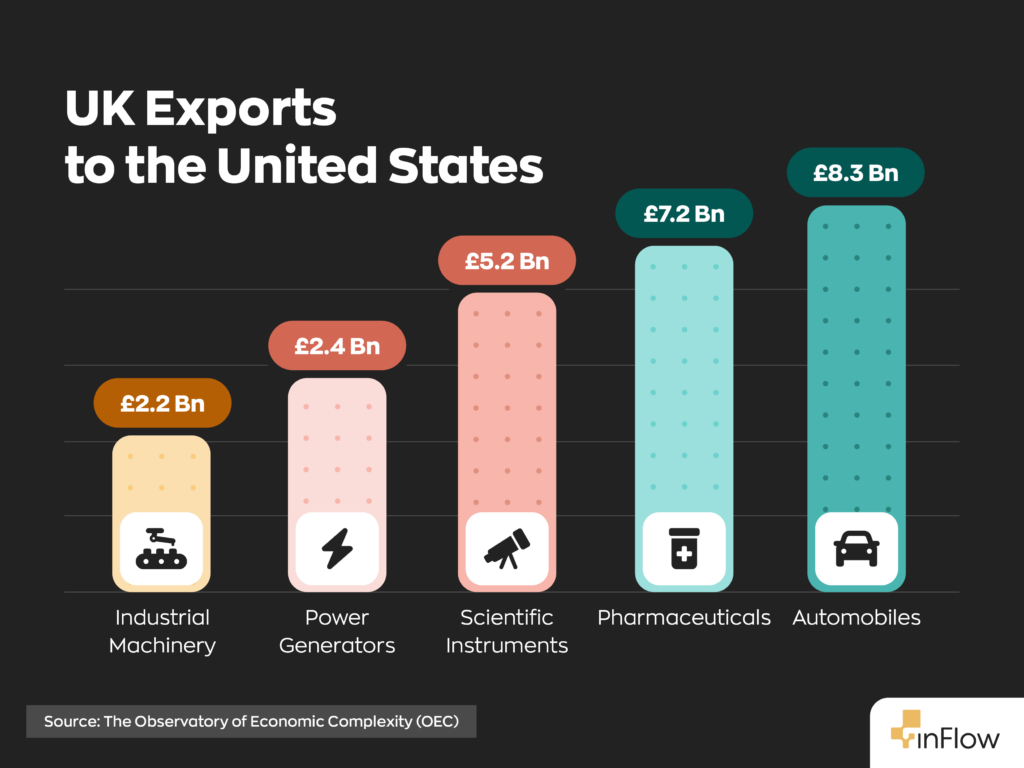

The automotive, steel, and aluminium industries have been hardest hit, having received a considerably higher tariff of 25% on all UK exports to the United States. And while the pharmaceutical industry has managed to escape the icy grip of Trumpified tariffs, this industry is expected to be next in line. From a broader perspective, the main worry is that increased costs from US-imposed tariffs could lead to higher consumer prices and inflationary pressures here in the UK.

How will US tariffs impact my small or medium business?

To understand how the tariffs may affect your business, you’ll need to take a close look at your supply chain. Firstly, consider how reliant you are on the US market. If part of your customer base lives in the United States, you’ll unfortunately have to pay higher taxes on those particular exports.

In this case, it might be tempting to pass those extra costs onto your customers. On the face of it, this makes a lot of sense. Except by doing so, you risk losing out to competitors who choose to front the costs themselves. In essence, small and medium UK businesses face a tricky dilemma: absorb the extra costs and endure reduced margins, or pass the costs onto US customers and risk weakening the competitiveness of your product.

Additionally, you’ll likely experience less demand among US customers due to higher prices and a weakening national economy. The US’s global 10% tariffs cause significant inflationary pressure, reduced consumer spending, and supply chain instability. For UK SMBs, this may result in reduced orders, cancelled contracts, and slower growth in what is often a key export market.

Why your supply chain matters more than ever

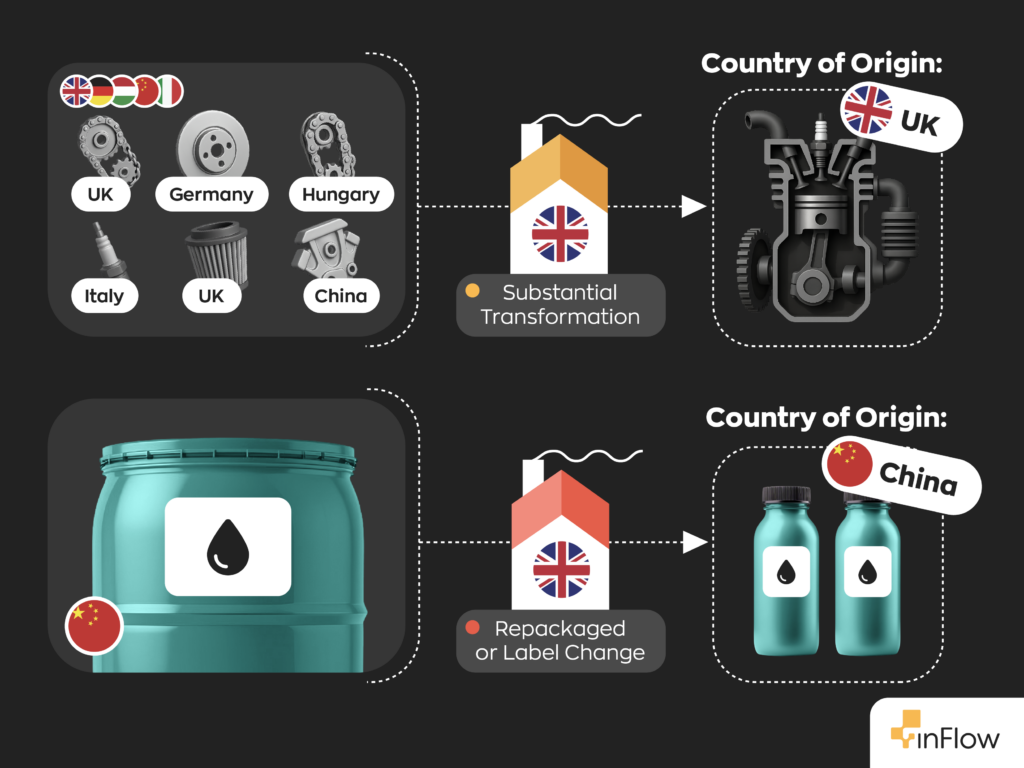

This is where things get a bit technical, but also where you have some level of control. Tariffs are based on where a product is considered to have been made, or more specifically, where it undergoes substantial transformation. In plain terms, that means the point in your supply chain where your product becomes something new (i.e. something with a different name, function, or use).

For example, if your business imports components and assembles the final product in the UK, it’s likely to be classified as UK-origin and now subject to the 10% tariff. If you only add a label or packaging, the origin stays with the original country.

But origin isn’t just about the process, it’s also about proof. You’ll need to keep detailed documentation showing where the “transformation” occurred. That includes supplier declarations, manufacturing steps, cost breakdowns, and more. Without it, US customs could apply penalties, delays, or even refuse your goods at the border.

Keep in mind that different product types have different rules. Industries like automotive, textiles, and pharmaceuticals face stricter origin thresholds and higher documentation standards.

Where things get challenging for SMBs

For smaller businesses, this level of complexity can feel overwhelming. Many don’t have in-house logistics or trade compliance teams, which means adapting to these changes can be time-consuming, costly, and disruptive.

Plus, it’s not just about origin rules. The broader impact of tariffs can affect every part of your supply chain, from supplier reliability and lead times to how much inventory you carry and when you reorder stock. Not to mention, just because you may decide not to raise your prices doesn’t mean your suppliers won’t either.

Smarter planning can ease the pressure

While you can’t control the tariffs themselves, you can control how you respond to them. One of the most effective ways to stay resilient is through smarter inventory planning. For starters, demand forecasting and stock optimisation can help you anticipate sales patterns and seasonal trends, so you never overstock – or worse, run out. Holding safety stock of high-risk items is also a good idea. It can keep your operations moving if shipments are delayed or disrupted due to tariff-related issues.

Tracking supplier performance is another key piece of the puzzle. When you know which suppliers are dependable and which tend to drop the ball, you can adjust early and avoid unpleasant surprises. Lastly, prioritising your inventory by investing more in high-margin or high-demand products ensures your resources are going where they’ll have the biggest impact. These practices don’t just reduce risk, they give you a clearer picture of your costs and help you make confident decisions, even when things get unpredictable.

A practical tool to support you

If you’re looking for help staying on top of all this, inventory management tools can lighten the load. For instance, software like inFlow allows you to track stock across your supply chain, monitor supplier performance, and generate the documentation you may need at customs – all in one place. Ultimately, inventory management software like inFlow helps by giving you the right information at the right time in a clear and simple way.

The bottom line

The newly imposed US tariffs are a challenge, but not an insurmountable one. With a bit of forward planning, the right systems in place, and a clear understanding of your supply chain, UK SMBs can reduce the tariff impact, stay agile, and uncover new opportunities even in turbulent times.

If you’re ready to get organised, a closer look at your inventory processes might be the best place to start.

0 Comments