Key takeaways

- FIFO (First In, First Out) is an inventory valuation method where the oldest inventory is recorded as sold first.

- It’s especially useful for perishable goods or items that may become obsolete, as it helps reduce waste and maintain accurate inventory value.

- FIFO results in higher profits on paper during times of inflation because older, cheaper inventory is recorded as sold while newer, more expensive inventory remains in stock.

- Many accounting standards, including IFRS, allow FIFO, making it a compliant and widely accepted method.

- FIFO can simplify bookkeeping by matching inventory flow with actual physical flow, which is helpful for businesses that physically rotate stock.

- Tools like inFlow make it easier to track and apply FIFO automatically, minimizing manual errors and ensuring consistent inventory valuation.

The FIFO method stands for first-in, first-out, and the LIFO method stands for last-in, first-out. FIFO and LIFO have a huge effect on how you end up reporting your business profits. Depending on the type of business you run — and where you run it — you may not actually have a choice in which of these systems you’ll use. The important thing is to understand how they work and then stay consistent throughout all of your records and reports. This will minimize any possible headaches when it gets closer to tax season.

The acronyms are fairly self-explanatory, and they’re basically opposite ways of tracking the value of your ending inventory (EI). What isn’t so obvious is that FIFO and LIFO aren’t about tracking physical items, but rather about recording the costs of those items to your business.

If you pour three different bags of M&Ms into a jar, you don’t actually have to find and count the batch that first made contact with the bottom of the jar. All that these systems require is that you account for the cost you paid for each of the three bags of candy, and when you ended up selling each batch.

If you’re interested in a quick overview of both FIFO & LIFO, you can watch this short video clip from our new podcast. We cover this topic along with many others. So be sure to watch the full episode.

How to do the first-in, first-out method

In order to successfully conduct the FIFO inventory method, you should do the following:

- Organize stock: Ensure older inventory is shelved in front of newer stock to facilitate easy access and reduce the likelihood of items expiring.

- Regular audits: Conduct frequent checks to verify that products are moving as intended and adjust any misplaced items promptly.

- Consistent documentation: Maintain accurate and up-to-date records of inventory intake and sales to streamline the tracking process.

- Employee training: Educate staff about the importance and procedures of the FIFO method to ensure company-wide adherence.

- Monitor shelf life: Pay close attention to expiration dates and rotate products regularly to minimize spoilage or obsolescence.

By implementing these strategies, businesses can effectively manage their inventory, enhancing efficiency and maintaining product quality.

What does FIFO require?

The following are necessary to successfully use the FIFO inventory method:

- Inventory management system integrated with FIFO tracking capability;

- Clearly labeled stock with purchase or production dates;

- An efficient storage system for easy access to older stock first;

- Regular inventory audits to ensure FIFO compliance;

- Accurate record-keeping of stock movements.

Implementing these elements ensures that older inventory is sold or used first, reducing the risk of obsolescence or spoilage.

How to calculate FIFO

To calculate inventory using the FIFO method, begin by identifying the oldest inventory items. In FIFO, the oldest costs are assigned to the cost of goods sold (COGS) first. Follow these steps:

- Determine the cost of beginning inventory: List all inventory purchases in chronological order with their corresponding costs and quantities.

- Calculate the cost of goods sold (COGS): Start with the oldest inventory and work forward until the number of goods sold is reached. COGS = (cost per unit of oldest inventory) x (quantity sold).

- Calculate ending inventory: To calculate ending inventory, subtract the quantity sold from the total inventory and account for the remaining unsold items. Ending Inventory = (remaining units) x (cost per most recent inventory).

These calculations ensure that the costs for sold items reflect the older purchase prices, aligning with FIFO methodology for accurate financial reporting.

Effect on the cost of goods sold

With either method, the overall value of your inventory is still the same. What changes is how the cost of goods sold (COGS) is reported, and COGS affects profit. Expressed in a basic form, the formula for profit is: profit = revenue – COGS.

What’s interesting is that there would actually be no real difference between FIFO and LIFO if it weren’t for factors like inflation. However, when you factor in inflation (which raises COGS over time), then a company that uses LIFO will end up reporting less profit than if it were to use the FIFO system.

This is a defining difference between these two costing methods, because it can directly affect the amount of tax that a business pays. In general, the worldwide standard is the FIFO method. LIFO is not allowed in most countries due to how it can understate profits, but it can be used in the United States. We’d advise you to check with your accountant about which system you should be using to track your inventory, since it varies by region.

Tax benefits

The FIFO inventory method can offer tax benefits to businesses, particularly in times of rising prices. By using FIFO, a company records the cost of its earliest purchased inventory against revenue, reflecting lower costs on its balance sheet and reducing its COGS. With lower COGS, the business reports higher profits on its financial statements, which might seem contrary to tax benefits.

However, in the broader strategy, this approach helps in better inventory management and aligns with income reporting policies. The primary tax benefit arises from creating reserves with the improved cash flow due to realistic profit reporting, which can be reinvested in business operations or used to settle liabilities. While immediate tax savings may not be evident, the financial clarity and stability facilitated by FIFO can lead to long-term strategic tax planning advantages.

The first-in, first-out method and different types of business

Aside from region, the type of business you manage will also determine what kind of costing system you should use. This method is highly suitable for businesses dealing with perishable goods, as it helps ensure that products are sold in the order they are received, minimizing waste. Grocery stores and restaurants, for instance, benefit significantly from FIFO as it aligns with the need to keep inventory fresh.

However, the appropriateness of FIFO also depends on the business size. Small businesses, particularly those with limited storage, might find FIFO easier to manage because it ensures a quick turnover of inventory and reduces holding costs. On the other hand, larger businesses with extensive and diverse inventories might struggle with FIFO’s administrative complexities, unless they have robust inventory management systems in place. They might require more sophisticated systems to track and manage the sequential sale of older stock effectively. Consequently, while FIFO can be beneficial for managing inventory effectively, its suitability can vary significantly with the nature and scale of the business.

Example of first in, first out in practice

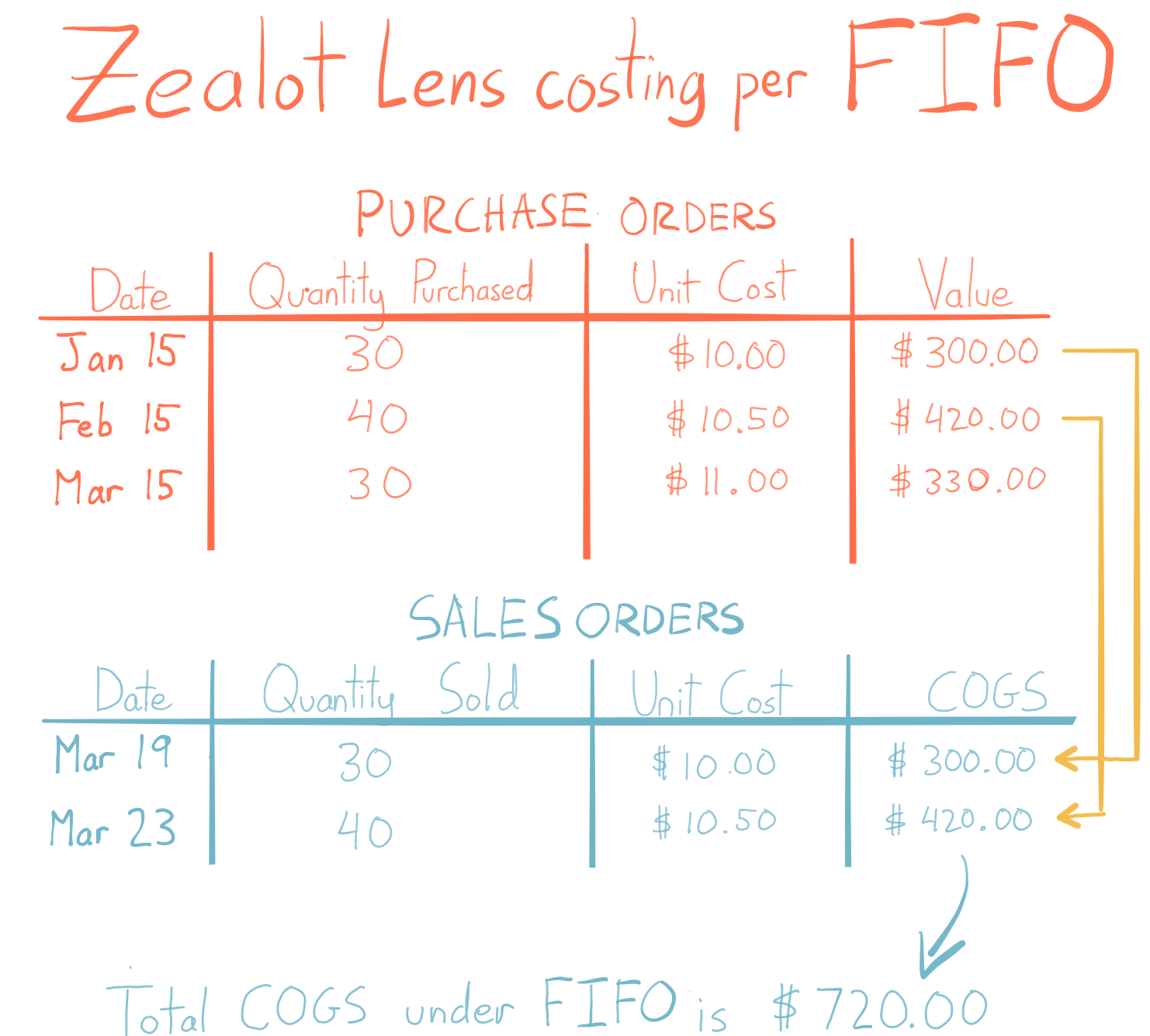

Imagine there is an eyeglass retailer called Archon Optical. If Archon Optical ran on FIFO, here’s how they would report the COGS over three months:

More on the last-in, first-out method

The LIFO method isn’t as commonly used because it isn’t allowed by the International Financial Reporting Standards (IFRS), due to how it affects the reporting of profits. It also isn’t a great indicator of the actual value of your ending inventory. Think about it this way: if you’re always taking candy from and adding to the top of the jar, how much are those old candies at the bottom really worth to you anymore? If you’re using LIFO, it could be months or years before you get to the product you first purchased — if it ever happens.

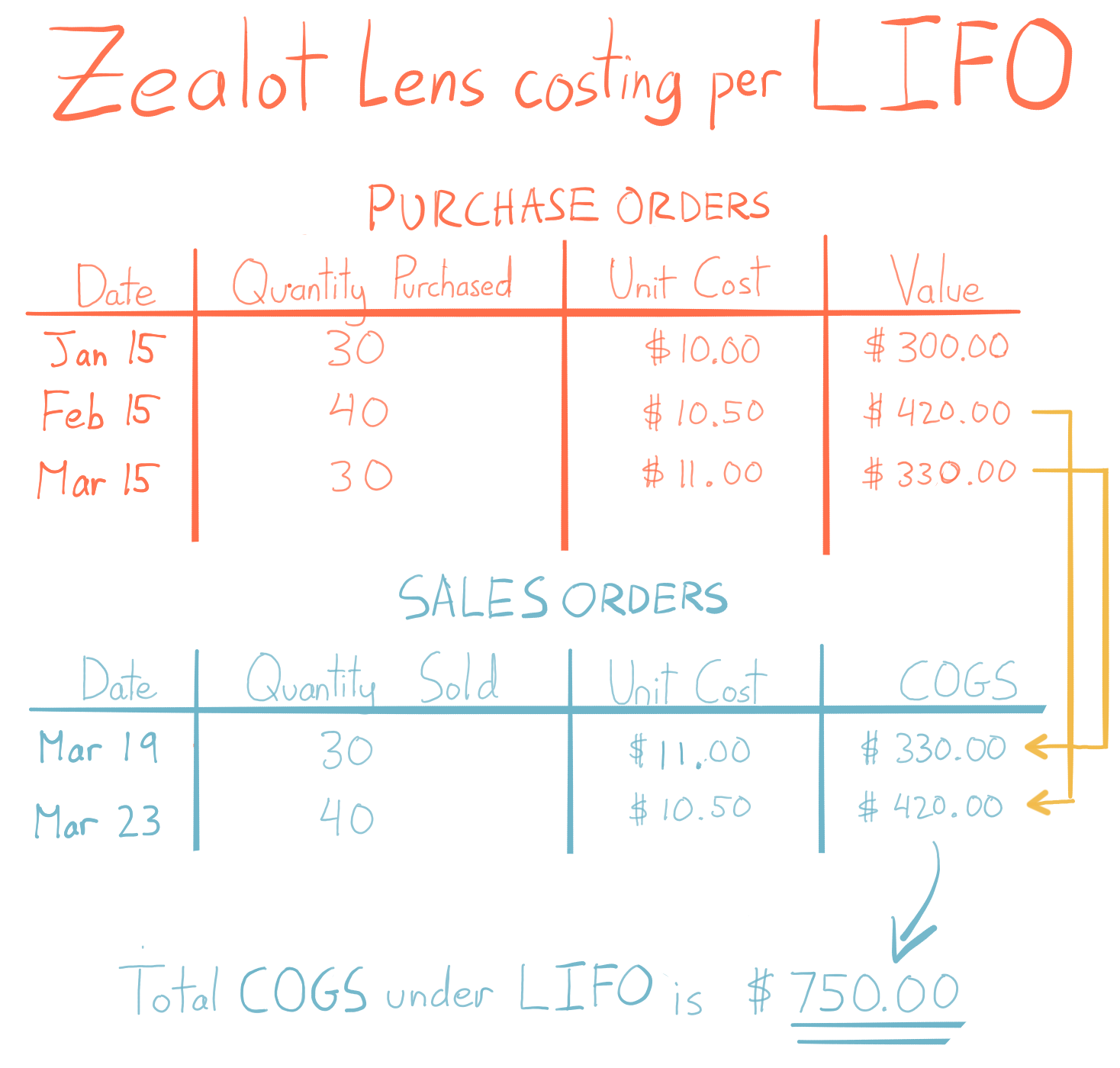

Here’s what it would look like if Archon Optical used LIFO to report on the past three months. Notice that the costs are still the same, but the COGS for recent sales is higher under LIFO. This is significant because a higher overall COGS means that the company will report less profit for those sales in January and February.

Tracking first in, first out and last in, first out

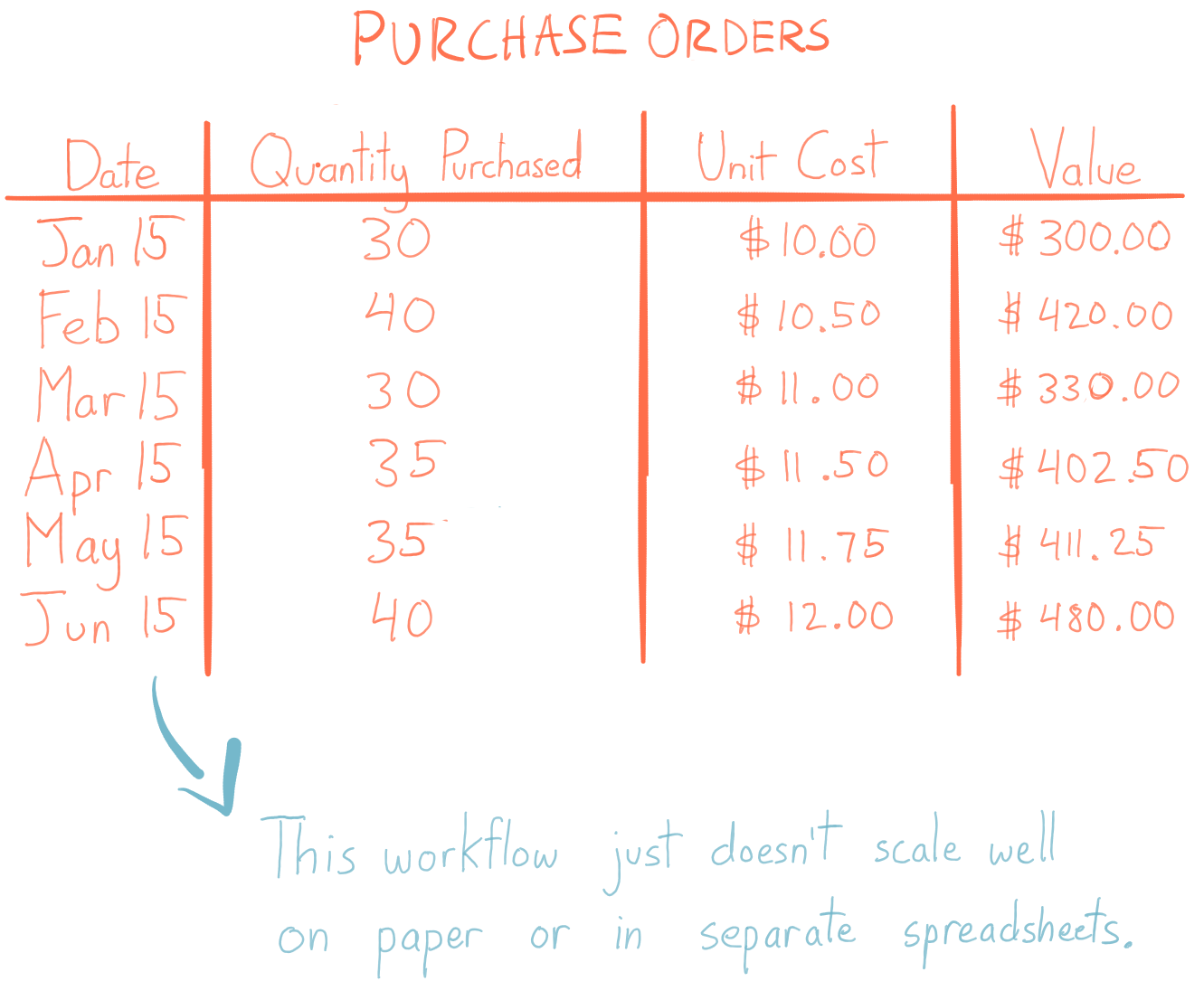

If you’re tracking your costs under a FIFO and LIFO system, you’ll need to be accurate about which batches of product have been sold. This means you’ll need tables that look something like the ones in our Zealot example:

Software and tools for using the first-in, first-out inventory method

It can be a little exhausting to track all of the FIFO and LIFO layers manually, so why not use a tool that’s designed to track this for you? Using inventory tracking software like inFlow Inventory, you only need to enter purchase and sales orders, and our servers will crunch all the numbers for you.

Since Inflow can’t help me or my business with our FIRST IN FIRST OUT problem, should i go to Fishbowl who seems to have the FIFO problem worked out or do you suggest some other inventory program. I have 3 days to fix this mess that i’m in.

inFlow should be able to take care of FIFO no problem. What specific issues were you having? Please send a quick email to support@inflowinventory.com and they’ll do the best they can to help you out.

I apologise, but, in my opinion, you are mistaken. Let’s discuss. Write to me in PM.

Sorry Pablo, I tried emailing you at the email address you left here on the blog, but it didn’t work.

If you’d like to talk about the post, please email us at info@inflowinventory.com and ask for Thomas. That way I can make sure to follow up via email.