Key takeaways

- Dynamic pricing adjusts prices in real-time based on demand, competition, and market conditions.

- Peak dynamic pricing raises prices during high-demand periods, while segmented dynamic pricing offers different prices to specific customer groups.

- Dynamic pricing doesn’t always raise prices; it can also help clear aging or seasonal inventory by strategically lowering prices.

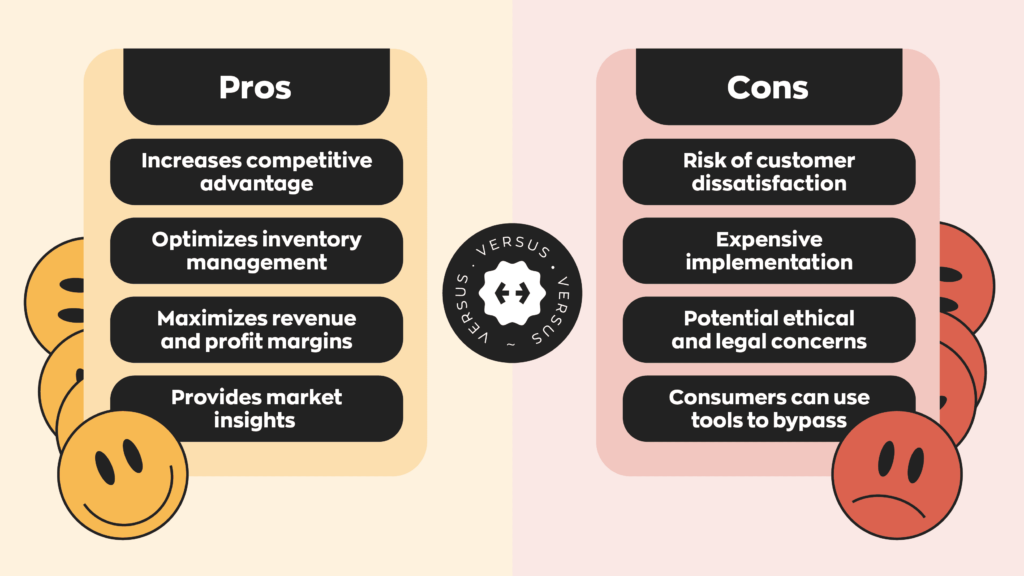

- Benefits include higher revenue and better inventory optimization.

- Drawbacks include customer backlash, ethical concerns, and challenges caused by VPNs or proxies.

- Successful implementation requires clear goals, strong customer research, and the right tools to analyze data.

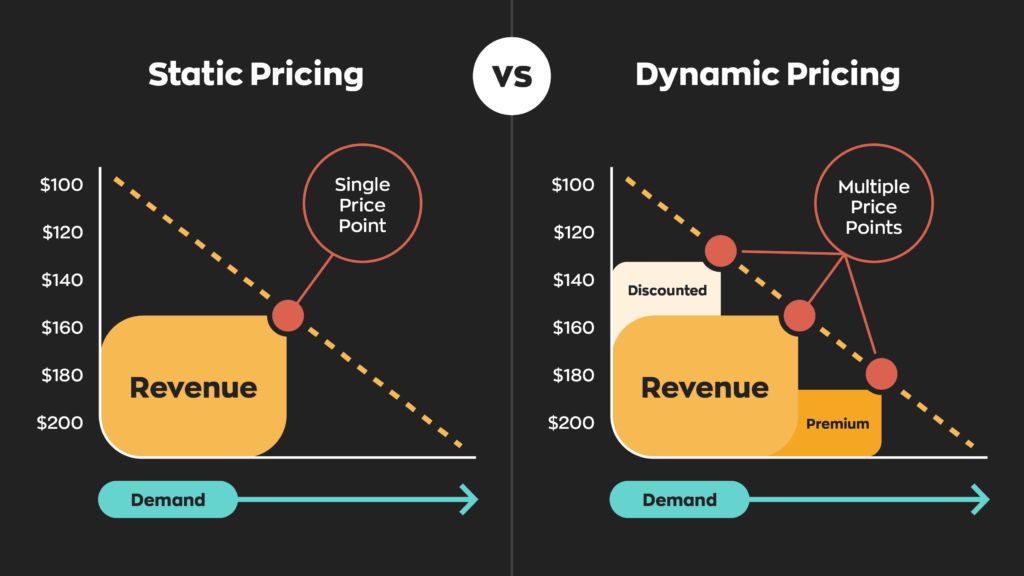

In simple terms, a dynamic pricing strategy means having flexible prices that rise or fall according to consumer demand. The dynamic pricing strategy aims to maximize profits by always selling a product or service at the highest price a customer will likely pay. It differs from static pricing and other common pricing strategies because it constantly adjusts using real-time data and external market factors.

How does dynamic pricing work?

Two important kinds of dynamic pricing will interest small businesses in particular:

Peak dynamic pricing is helpful for industries with peak seasons or times, such as travel, tourism, and accommodation. Using popular “peak” seasons as a guide, you can adjust your prices to maximize revenue during popular months when people spend more money. Uber has famously used this pricing strategy, charging customers a premium for rides booked during times of high app usage. While travel and tourism are great examples of this model, it could also be applied to many industries — basically, anything that might see an influx in interest at a particular time of year.

On the other hand, segmented dynamic pricing is when you calculate different prices based on a specific group of customers. You can divide customers by age, location, or other factors. An example of this would be to offer special pricing for older adults.

One of the major misconceptions about dynamic pricing is that it always results in higher prices, but that’s not the case. If the value or demand of a product decreases, dynamic pricing can help ensure you still make the most out of a sale, even if it’s less than expected. This makes dynamic pricing ideal for seasonal inventory.

For example, if you’re a food business, dynamic pricing can help you sell produce before it expires. In clothing, reducing prices before the end of a season can help you shift stock and leave room for new trends.

The benefits of dynamic pricing

Dynamic pricing is an ideal strategy that virtually every industry can use in some way. Firstly, it can increase your revenue across the board since it tailors prices according to customer expectations and market trends. As demand rises, so too does the value of the product.

This pricing strategy can also help small businesses gain a larger market share by analyzing and adjusting their prices with competitors 24/7 and actively considering external market factors, like supply chains, and how they may impact product availability.

Examples of successful dynamic pricing implementation

Over the last several years, many household names have used dynamic pricing to great success. We’ve already mentioned Uber, but another well-known company is Airbnb. It has its own built-in Smart Pricing feature, which automatically changes nightly prices at accommodation based on customer demand, seasonal times of the year, and if any special events are happening in the immediate area, such as concerts or festivals.

Amazon uses dynamic pricing to alter the prices of goods throughout the day. This is done to reflect changes in the market and competitor prices and help increase its profit margins on items customers show greater interest in buying.

The drawbacks of dynamic pricing

Although dynamic pricing has many benefits, it’s not foolproof, and some drawbacks might impact its suitability for some businesses.

As more consumers become aware of the practice, businesses may receive public backlash and a drop in loyalty over rising prices. For example, in 2024, Wendy’s came under fire when their CEO announced plans to test dynamic pricing in 2025.

Critics also claim dynamic pricing creates a class system among consumers. When tickets for Taylor Swift’s Eras Tour went on sale, a surge in demand meant that resale sites offered tickets for up to $22,000 — well beyond the price range of many fans. This debacle caused worldwide headlines, with calls to legislate dynamic pricing.

Another growing problem is that more customers are finding ways to avoid it, including using a proxy service or virtual private network (VPN). These technologies allow people to disguise their IP address, making it seem like they live elsewhere. This can prevent businesses from adjusting their prices, as customers can “relocate” to countries that might typically receive cheaper prices.

VPNs also work as a cybersecurity tool, encrypting the internet connection itself and offering the maximum level of privacy. With a VPN, websites and internet providers cannot monitor any online activity. As such, it can be difficult to collect data that can be used to inform dynamic pricing.

Is this pricing strategy legal?

A question often asked by small businesses interested in this trendy pricing method is whether or not it’s legal. Though these policies have come under scrutiny, the short answer is that dynamic pricing is acceptable in many jurisdictions, with some exceptions.

In the U.S., for example, companies can adjust prices, provided they don’t base them on gender, race, or religion. In Europe, companies are free to determine the prices they charge as long as “they inform consumers about the total price” and there’s no deception during the booking and payment process.

Tips and considerations for implementation

If you want to implement a dynamic pricing strategy, you need to prepare accordingly. The first and most crucial challenge is setting your goals. Ask yourself what you want to achieve and what timeframe to measure results in. This might depend on your industry, but many businesses want to increase revenue or find a new way to shift stock, for example.

Next, businesses must invest time and effort into researching their customer base. This will help them find out what their customers want and the maximum amount they’re willing to spend on it. Naturally, this will require a lot of data, which isn’t always easy to access. Thankfully, modern software allows users to conveniently pull reports for their sales, purchases, and inventory.

Dynamic pricing has been proven to be highly effective in helping businesses succeed. The rise in artificial intelligence technologies means you can gather many insights and adjust prices automatically, helping you focus your time on other parts of your business.

With the proper care and planning, virtually every business can implement dynamic pricing to improve revenue, save time and effort, and become more cost-effective.

Adjusting prices in real-time can be a game-changer for businesses, but it’s a fine line between boosting profits and frustrating customers. This article does a great job explaining the balance needed for an effective dynamic pricing strategy!

Hey PriceIntel,

We appreciate the kind words. Thanks for reading 🙂

Cheers,

Jared