Key takeaways

- VAT (Value Added Tax) is a tax added to most goods and services in the UK. Businesses collect it from customers and pass it along to His Majesty’s Revenue & Customs (HMRC).

- You must register for VAT if your taxable turnover exceeds £90,000 in a rolling 12-month period, or if you expect to cross that threshold within the next 30 days.

- Having a VAT number allows you to reclaim VAT on business expenses and can enhance your credibility.

- The standard UK VAT rate is 20%, but certain goods are taxed at rates of 5% or 0%.

- It’s important to distinguish between zero-rated and VAT-exempt items, as only the former allow you to reclaim input VAT.

- Since April 2022, all VAT-registered businesses must comply with Making Tax Digital (MTD)—keeping digital records and using compatible software for VAT submissions.

Chances are, you’ve heard of VAT. But if you ask the average person what it actually is, you’ll probably get a bit of a shrug and a guess that it’s ‘some kind of tax thing’. Most people tend to file it under the same category as cleaning the gutters or organising old receipts – a task best saved for some mythical ‘later’ that never comes.

But here’s the thing. If you run a small or medium-sized business in the UK, VAT isn’t something you can afford to ignore. Not only is it essential for staying tax-compliant, but it also builds trust with customers and suppliers. And once your business turnover hits £90,000 in a rolling 12-month period, it’s not optional – it’s the law.

The good news? VAT isn’t as scary as it seems, especially when you understand the basics. In this guide, we’ll walk you through everything you need to know about UK VAT, from registering and handling reports to managing VAT in relation to your inventory and avoiding common pitfalls. By the end of this guide, you’ll be ready to handle VAT like a pro.

What is VAT?

VAT stands for Value Added Tax. If your business is VAT-registered, you’ll need to charge VAT on most goods and services you sell. You also pay VAT on goods and services you purchase for your business. This can include various types of inventory, things like raw materials, office supplies, packaging, equipment, or even cleaning services.

When you sell something, you collect VAT from your customers, then pass it on to His Majesty’s Revenue & Customs (HMRC) when you submit your VAT return. It’s like being a middleman for taxes. You collect it, you report it, and you pay it over. The key is keeping everything organised along the way.

What is a VAT number?

Once you register for VAT, HMRC will assign your business a unique VAT number. Think of it as your business’s ID badge for all things VAT. You’ll include it on invoices, VAT returns, and any correspondence with HMRC. It’s how the tax authorities know who’s who.

A VAT number also makes your business look more credible. And if you’re planning to sell internationally, it’s basically a must-have. Over 175 countries use a VAT-style system, so your VAT number acts like a passport when trading beyond UK borders. To see how VAT numbers play a role in managing international trade, check out our guide to VAT numbers for global businesses.

Do I need a VAT number?

Here’s the rule: if your business’s taxable turnover exceeds £90,000 in any 12-month rolling period, you must register for VAT. And if you expect to cross that threshold in the next 30 days, you need to register immediately.

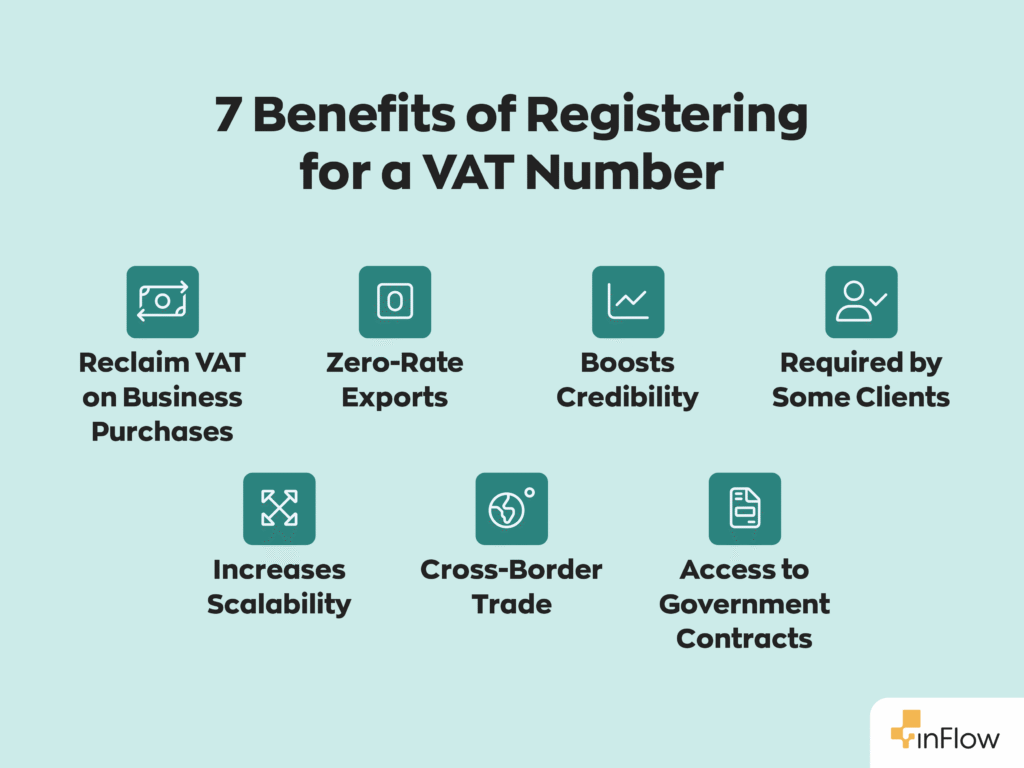

If your turnover is under the threshold, you can still choose to register voluntarily. Some businesses do this so they can reclaim VAT on expenses or look more professional to clients and suppliers. It does come with some extra admin, though, so it’s worth weighing the pros and cons.

What are the benefits of having a VAT number?

One of the biggest perks is that you can reclaim VAT on business expenses. So if you’re buying supplies, equipment, or paying for services from other VAT-registered businesses, you can get that tax portion back. It’s a great way to make your money go further.

VAT registration can also make your business look more established. Clients, especially larger organisations and B2B customers, often expect to work with VAT-registered suppliers. Having that little number on your invoice can go a long way in building trust.

And then there’s the most important reason: staying on the right side of HMRC. If you hit the VAT threshold and don’t register, you can expect a fine. The longer you wait, the more the fine increases. For example, if you’re 9 months late, the penalty is 5% of the VAT you owe. Between 9 and 18 months, it jumps to 10%. And after 18 months, it’s 15%. So it really does pay to be on time.

How do I get a VAT number?

Getting a VAT number is pretty straightforward. You register with HMRC online and provide some details about your business, like your turnover, the nature of your business activities, and your bank account information. Once you’re approved, you’ll receive your VAT number and can start charging VAT on your sales.

What is the UK VAT rate?

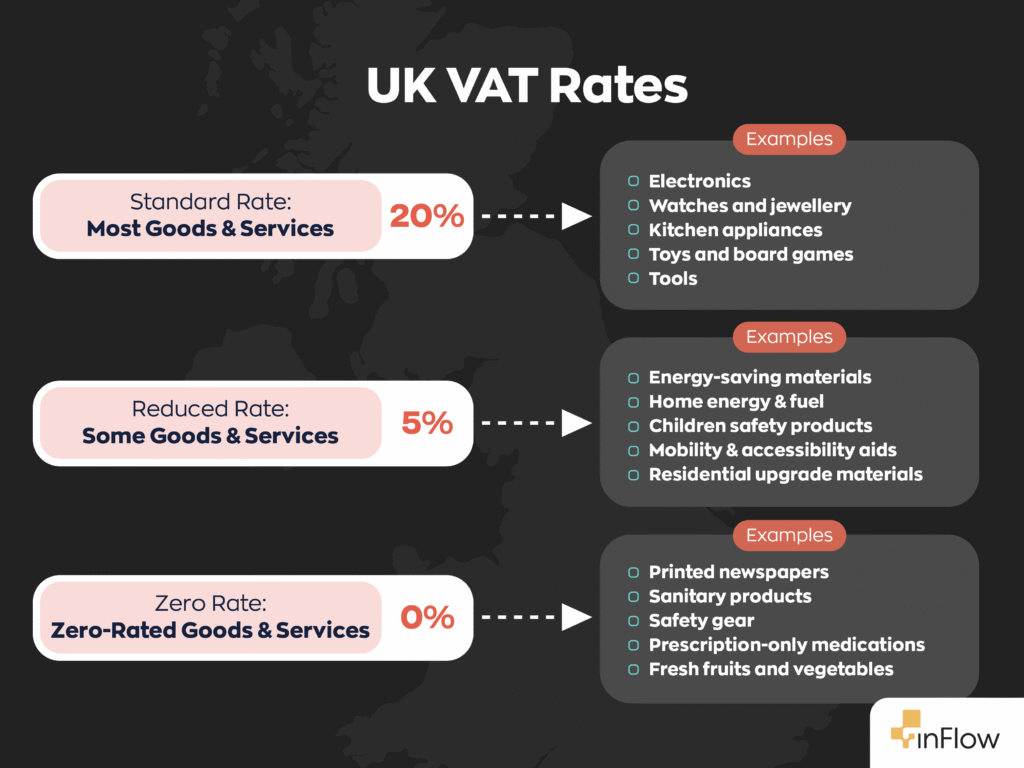

The standard VAT rate in the UK is 20%. That applies to most goods and services. However, there are some exceptions. Certain goods are charged at a reduced rate of 5%. These include things like children’s car seats and domestic energy. Then there are items that are zero-rated, like most food and children’s clothing. You won’t charge VAT on these sales, but you can still reclaim VAT on related business purchases. So, not all VAT is created equal. And when you’re doing your VAT returns, these different rates matter.

How do I report VAT?

Most VAT-registered businesses in the UK submit a VAT Return to HMRC every quarter. This report includes the VAT you’ve charged on sales (called output tax) and the VAT you’ve paid on purchases (input tax). If you’ve charged more VAT than you’ve paid, you pay the difference to HMRC. If you’ve paid more than you’ve collected, HMRC refunds the difference.

What records do I need to keep?

To remain compliant, you must maintain detailed records of all your sales and purchases. That means invoices, receipts, and any other documents that show the VAT amounts you’ve charged or paid. These records need to be kept for at least six years. Think of it like a business diary, only instead of emotional thoughts, it’s all transactions and tax data. And if you’re using inventory software like inFlow, this kind of record-keeping becomes a whole lot easier. You’ll have a digital trail of every item in and out, which comes in handy when it’s time to file your return.

Common VAT mistakes to avoid

VAT has its fair share of tripwires. Some of the most common ones include:

- missing the registration deadline

- mixing up business and personal expenses

- keeping incomplete records

- misclassifying goods that are zero-rated or exempt

Even experienced business owners get tripped up sometimes. That’s why it’s a good idea to check in with an accountant or tax adviser if you’re unsure. They’re like your VAT satnav – helping you avoid wrong turns and getting you to your destination without a panic attack.

What’s the difference between zero-rated and VAT-exempt?

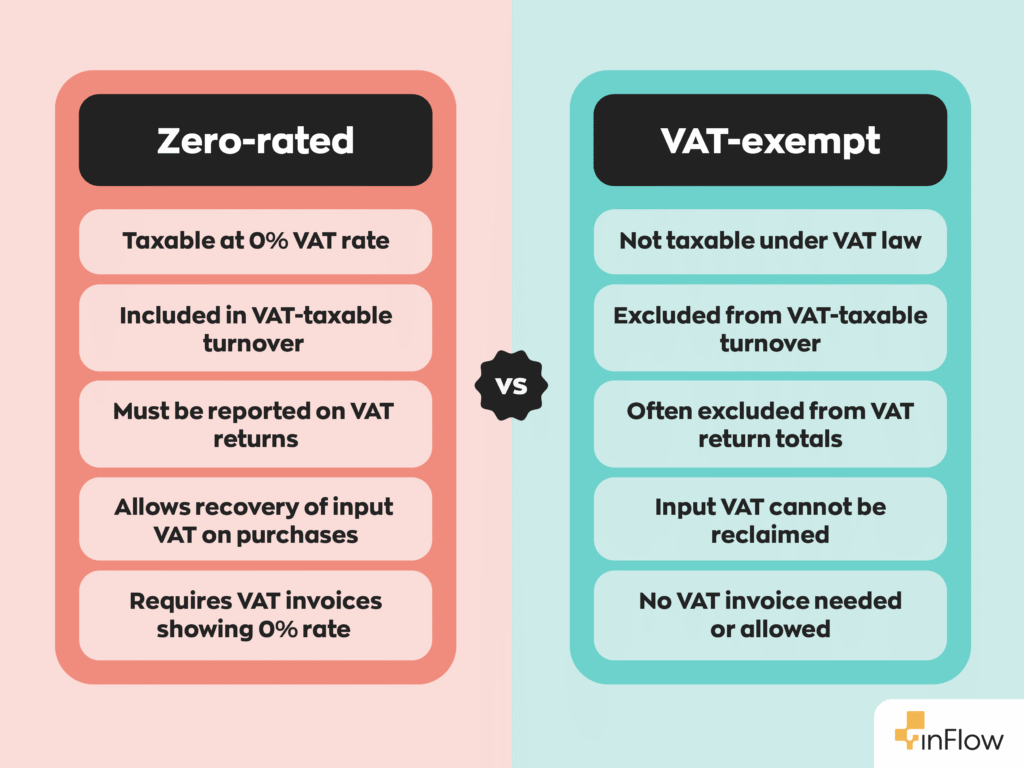

It might sound like they mean the same thing, but they don’t.

Zero-rated items are still taxable, just at 0%. That means you don’t charge your customers VAT, but you can reclaim the VAT you’ve paid on business purchases related to those goods.

VAT-exempt items, on the other hand, are totally outside the VAT system. You don’t charge VAT on them, and you can’t reclaim VAT on expenses related to them either.

Getting this right is essential, especially if you’re buying a lot of goods or services connected to those items. It could be the difference between a healthy refund and leaving money on the table.

A quick word on Making Tax Digital (MTD)

Since April 2022, all VAT-registered businesses – including the small ones – have to follow HMRC’s Making Tax Digital rules. This means you need to keep digital records and use MTD-compatible software to submit your VAT returns.

The idea is to reduce errors and streamline reporting. So if you’re still tracking sales and stock in spreadsheets, now’s the time to level up. Tools like inFlow can help keep your inventory, VAT, and reporting all in sync.

Wrapping up

VAT doesn’t have to be a mystery or a monthly headache. Once you understand the basics (like when to register, what rates apply, and how to report), it becomes another part of running your business smoothly.

And when you’ve got your inventory sorted and your records clear, UK VAT becomes a lot less intimidating. Whether you’re just getting started or brushing up on the rules, understanding VAT is a win for your business.

Looking for a tool that makes VAT and inventory tracking simple? inFlow is built to help small businesses stay organised, compliant, and in control. You handle the sales, we’ll help with the numbers.

0 Comments