Key takeaways

- The minimis exemption, which allowed imports under $800 to enter the US duty-free, is being eliminated in phases, with full termination codified for 2027.

- China and Hong Kong lost eligibility in May 2025, and as of August 29, 2025, de minimis treatment ended for all countries, subjecting all imports to duties and full customs scrutiny.

- The change significantly increases costs, compliance requirements, and processing delays, putting heavy strain on SMBs that rely on low-cost international sourcing.

- Businesses must now handle full customs documentation, accurate HTS code classification, potential bonding requirements, and choose between informal and formal entry types.

- Shipping strategies are shifting toward bulk orders, nearshoring and onshoring fulfillment, and regional distribution hubs, requiring more working capital and storage space.

- To adapt, businesses should diversify suppliers, explore nearshoring or onshoring, implement automation for compliance, optimize inventory management, and update financial planning to handle new cost structures and cash flow demands.

The global ecommerce landscape is about to face a monumental regulatory shift. The United States’ de minimis exemption, which has allowed packages valued under $800 to enter the US duty-free, is being systematically eliminated, with complete termination scheduled for 2027. This change poses a major threat to companies that have built their business around low-cost, direct-to-consumer shipping from overseas suppliers.

So, if your business relies on international suppliers, cross-border ecommerce, or low-value shipments, this article is for you. We’ll break down what the de minimis exemption is, what its elimination means to you, and lastly, how you can prepare for this major disruption.

What is the de minimis exemption?

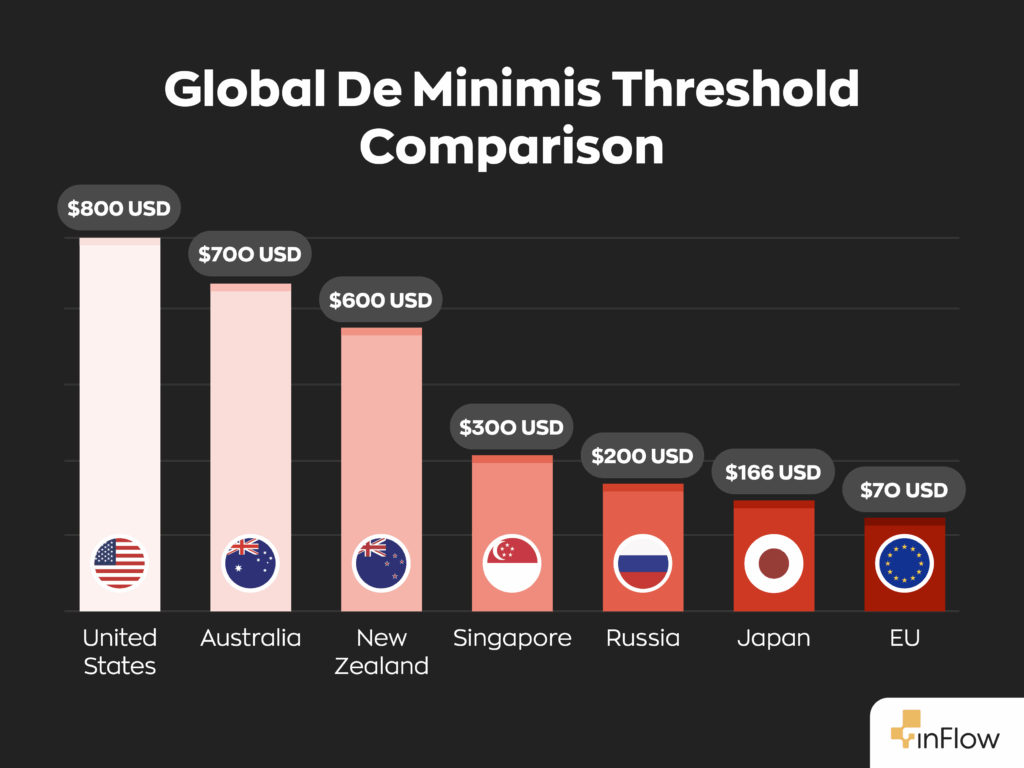

For years, the de minimis exemption has been a cornerstone of international trade policy. It allows goods valued at $800 or less to enter the United States without paying duties or undergoing an extensive inspection process. The de minimis exemption is among the most generous globally after it was raised from $200 to $800 back in March 2016.

This system has done more than just reduce duty fees. It also simplified the entry process, requiring less documentation, resulting in faster processing times. Platforms like Temu, Shein, and AliExpress have thrived in this environment, flooding the US market with minimal regulatory oversight.

The original intent of the policy was to reduce the administrative burden on customs officials for items that wouldn’t generate significant revenue. However, the explosive growth of ecommerce in recent years has made de minimis a major trade policy issue.

The end of the de minimis exemption

The good news is, the elimination of de minimis isn’t happening overnight. The US government will be rolling it out in phases, and it’s vital to understand the timeline to help your businesses plan your transition strategy.

Phase 1: China and Hong Kong (Completed May 2, 2025)

The first significant restriction started in May 2025, when products originating from China and Hong Kong lost de minimis eligibility. Since Chinese goods represented 76% of de minimis shipments in 2024, this first phase has already had a massive impact on many businesses of all sizes.

Phase 2: All Countries (August 29, 2025)

The Trump administration accelerated the timeline, eliminating de minimis treatment for all countries, which took effect on August 29, 2025. This means all imports, regardless of value or origin, now face applicable duties and enhanced customs scrutiny.

Phase 3: Legislative Codification (2027)

The recently passed “One Big Beautiful Bill Act” formally codifies the end of commercial de minimis shipments by July 1, 2027. This move will ensure the changes become permanent regardless of future administrative decisions.

Impact on ecommerce businesses

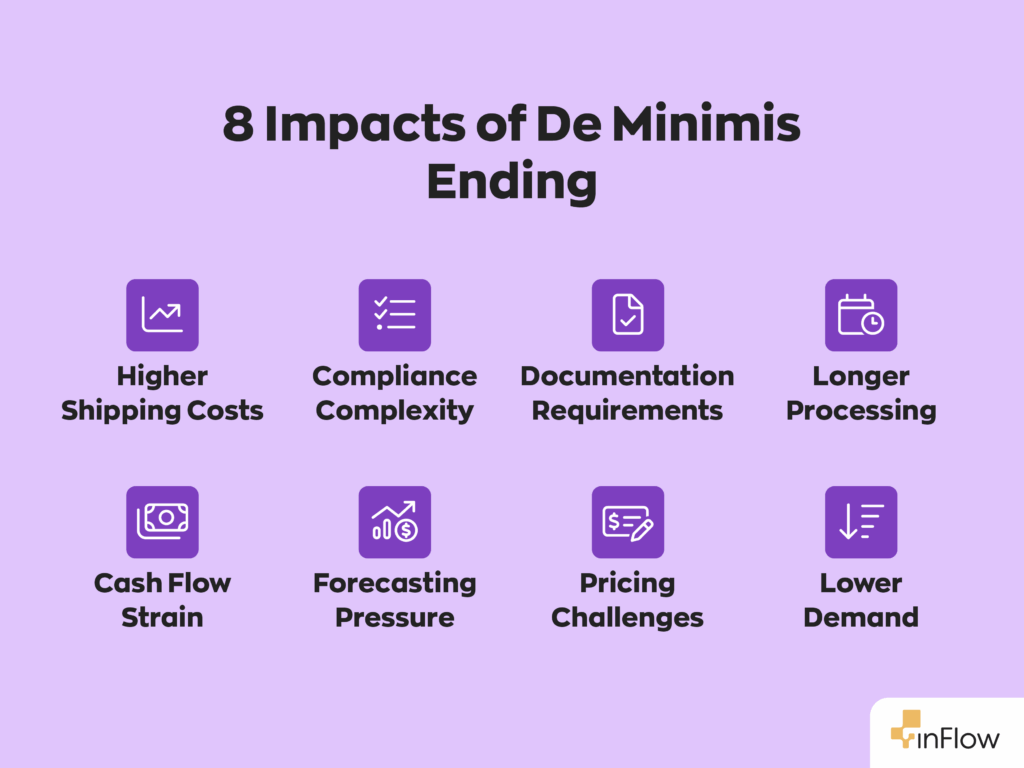

For companies that have built their business model around low-cost international sourcing, the elimination of de minimis exemption creates immediate and long-term challenges. These include:

- Increased costs: The end of di minimis couldn’t have come at a worse time for US businesses, who are already dealing with increased duties thanks to new tariffs. Every imported item now faces duties that could exceed 50% for certain Chinese goods. Businesses must decide whether to absorb these costs or pass them on to consumers.

- Market positioning: Increased costs have made it much more difficult for SMBs to stay competitive. Larger companies have a lot more resources and can absorb the new costs associated with the end of de minimis. The little guys, on the other hand, often operate with razor-thin margins which means they’re less likely to be able to absorb the massive increase in duties.

- Consumer behavior: When prices increase, people tend to spend less. It’s inevitable. Businesses must prepare for potential decreases in demand and adjust their financial projections accordingly.

- Documentation requirements: All shipments now require proper customs entry forms with accurate 10-digit Harmonized Tariff Schedule (HTS) codes. This eliminates the simplified Entry Type 86 process that many businesses used for smaller shipments.

- Processing delays: Enhanced customs scrutiny means longer processing times. Packages that previously cleared customs in a matter of hours may now be sitting for days or even weeks.

- Compliance burden: Businesses must ensure accurate product classification, proper documentation, and compliance with all applicable regulations. Mistakes can result in penalties, delays, or even shipment rejections.

New compliance requirements

The new costs associated with the elimination of de minimis exemption are just the tip of the iceberg. For many businesses, the introduction of complex compliance obligations is the real kick in the teeth. These include:

- HTS code accuracy: As mentioned above, you must classify every product with the correct 10-digit HTS code.

- Entry type selection: Businesses must choose between Entry Type 11 (informal) for lower-value shipments or Entry Type 01 (formal) for higher-value or regulated products.

- Bonding requirements: Many shipments now require customs bonds to ensure payment of duties and compliance with regulations.

The time commitment required to ensure compliance will eat away at your administrative fees and ultimately could cost you more than the duties themselves.

International postal shipments

For packages sent through international postal networks, businesses face two duty calculation options. The first option is the ad valorem method, which applies the standard tariff rate based on the product’s country of origin and classification. The second is the specific duty method, which means you pay a fixed per-item rate ranging from $80 to $200 based on the applicable tariff percentage, though this option expires February 28, 2026.

How will the supply chain adapt to the end of the de minimis exemption?

The end of de minimis will force fundamental changes in how the global supply chain operates, especially for businesses that revolved around small, frequent shipments. Here are some of the most significant changes we’ll see in the coming weeks and months.

Changes to shipping strategies

The end of the de minimis exemption means bulk shipping is back, baby. Many businesses are making the shift from frequent small shipments to larger, less frequent bulk orders. This strategy is effective at reducing the per-unit duty cost but requires more working capital and storage space.

We’re also seeing more companies establish or expand their US-based fulfillment to avoid international shipping complications entirely. This represents a significant capital investment but provides long-term operational benefits.

Some businesses are even creating regional distribution hubs in countries with more favorable trade relationships. These centers act as intermediate points before final US delivery.

Changes to inventory management

The biggest change you’ll see in inventory management is the increase in required capital. Bulk purchasing requires more upfront investment in inventory, and larger inventory volumes demand more storage space.

Businesses will no longer have the amount of flexibility for quick reorders, which means accurate demand forecasting becomes critical to avoid stockouts or excess inventory.

How can businesses respond to the end of de minimis?

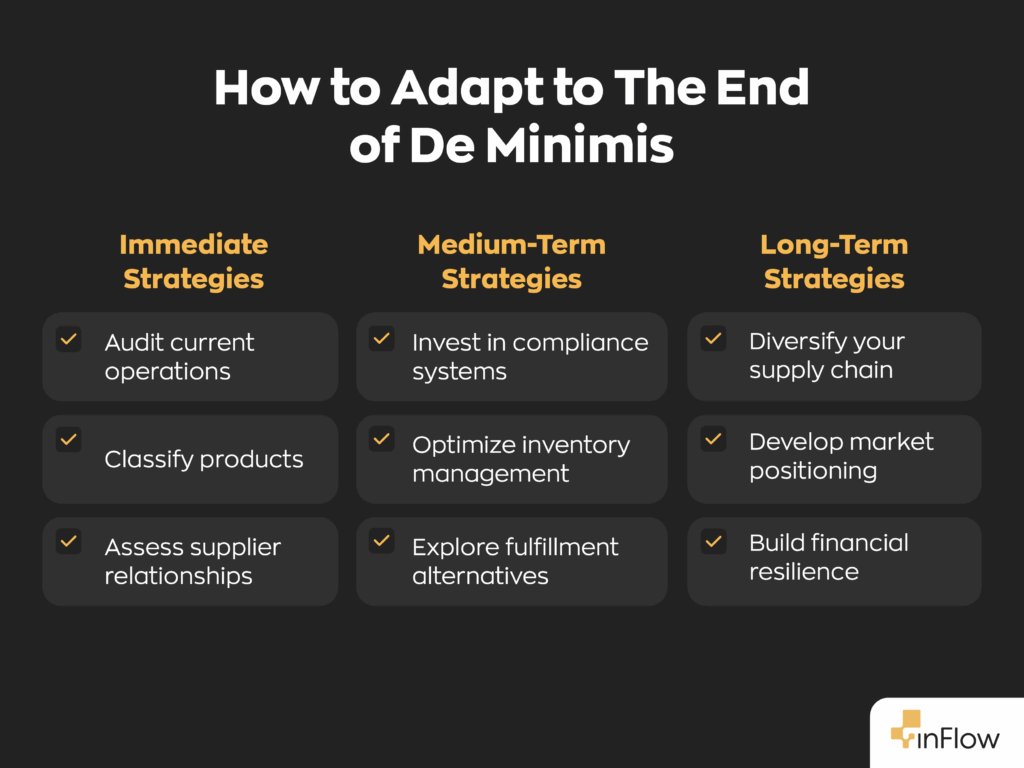

There is no denying that the end of de minimis exemption has put many businesses in a sticky situation. However, forward-thinking companies have risen to the occasion and started to implement comprehensive strategies to adapt to the post-de minimis world.

Supply chain restructuring

- Supplier diversification: Reducing dependence on a single country or supplier helps mitigate tariff impacts and provides flexibility.

- Nearshoring initiatives: While onshoring may still be cost-prohibitive, nearshoring may be the next best thing. By moving production closer to the US market, such as to Mexico or Central America, you can reduce shipping costs and complexity while maintaining lower duty rates.

- Onshoring initiatives: Where economically viable, shifting to US-based suppliers eliminates international shipping complications entirely. While this option seems attractive, the reality is that it’s just not possible in many cases.

Technology and process improvements

- Automated classification: Tech-savvy businesses are investing in software that automatically assigns correct HTS codes, reducing compliance risks and processing delays.

- Inventory optimization: Advanced inventory management systems help with demand forecasting, real-time inventory visibility, and automated reorder points, which in turn will help cash flow management. These solutions can also better track the total cost of goods, including duties and compliance expenses, enabling more accurate pricing and profitability analysis.

Financial planning

- Cost structure analysis: Businesses must recalculate their cost structures to account for duties, longer shipping times, and increased compliance costs.

- Pricing strategy revision: When costs increase, so do prices. Adjusting product pricing to maintain profitability while remaining competitive in the market is key.

- Cash flow management: Bulk purchasing and longer lead times require more sophisticated cash flow planning and potentially additional financing options.

Conclusion

The elimination of de minimis exemption isn’t just about increased duties—it’s about a fundamental overhaul of how international commerce operates. Companies that embrace this change and adapt their strategies accordingly will position themselves for long-term success in the evolving global marketplace.

For businesses managing complex international supply chains, having robust inventory management systems becomes even more critical. Tools that can track costs, manage compliance requirements, and optimize inventory levels will be essential for navigating the post-de minimis landscape successfully.

0 Comments